Given the dire state of EU–Russia relations, it is ironic how closely Europe’s political deadlock resembles a great and classic Russian tragedy: all politically feasible plans to support Ukraine resemble one another, in the sense that they are undesirable, while every politically unfeasible plan is unfeasible in its own particular way.

Just as the characters in Anna Karenina by Leo Tolstoy suffer countless personal trials and catastrophes in their search for spiritual and material fulfillment, so too has the European Union learned in recent weeks that it must overcome multiple, almost insurmountable obstacles in order to continue financing Kyiv’s war effort.

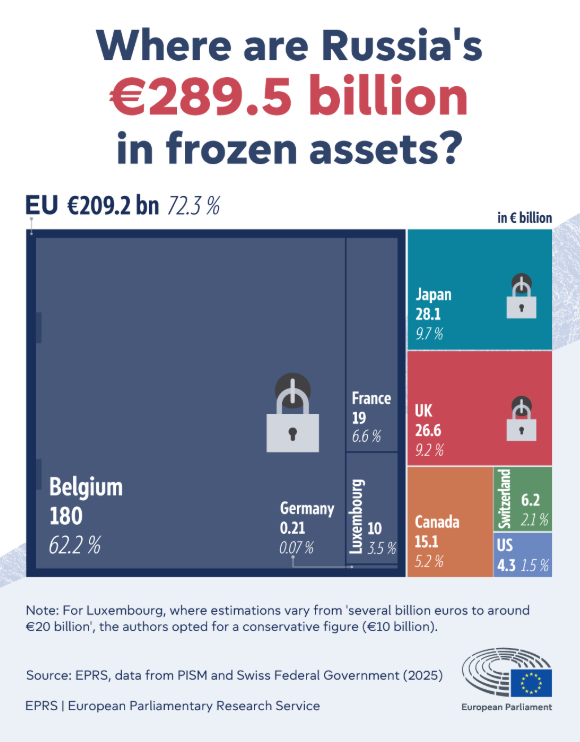

Use of frozen Russian sovereign assets? Belgium shouts non and nee.

Issuance of common European debt? Nem, shouts Hungary.

Bilateral grants from member states? Everyone cries out with one voice: No, nein, non, nej and нет.

So what is to be done? The answer to which the EU appears to have arrived is almost disarming in its simplicity, and its foolishness: ignore the troublesome Belgians.

Of course, the loud opposition of Prime Minister Bart De Wever to the so-called “reparations loan” has not shifted by even a millimeter since Ursula von der Leyen first proposed it in September.

And of course, De Wever’s domestic position has been significantly strengthened after the failed EU summit in October, with the right-wing Flemish nationalist receiving strong backing both from his five-party governing coalition, which includes Francophone centrists, and from traditional political opponents such as the bilingual Marxist Workers’ Party.

And of course, Belgium’s negotiating position has been further reinforced by France’s reluctance to make use of €19 billion in Russian sovereign assets held in its banks, a fact that makes De Wever’s resistance to EU pressure, and to pressure from Paris, to use the €185 billion in Kremlin funds stored in Brussels, comparatively entirely reasonable.

And of course, American peace efforts aimed at ending the war added yet another argument to De Wever’s rhetorical arsenal: that pushing forward the loan risks depriving the EU of critical leverage in future peace talks with Russia, as well as valuable funds for rebuilding Ukraine after the war.

Belgium proposed 40 pages of amendments

Last week, Belgium demanded nearly 40 pages of changes to the Commission’s legal text. Among them was the requirement that member states withdraw from more than 20 active bilateral investment treaties with Moscow, a condition which, even if approved by other EU states, would be legally impossible to implement in less than a week.

And of course, De Wever’s claim that the Commission’s plan for an indefinite freeze of Kremlin funds is unlawful was echoed this week by the President of the European Central Bank, Christine Lagarde, who stated that the loan scheme is the “closest” she has seen to compliance with international law, something which, strictly speaking, does not even mean that it is close.

A slippery line of reasoning

Nevertheless, EU diplomats and officials argue that Belgium will ultimately back down. When asked why, most resort to an almost Kantian line of reasoning, which even staunch Germanophiles such as De Wever are likely to regard as arbitrary.

It goes roughly as follows:

1) Ukraine has enormous financing needs.

2) These needs must be met.

3) Meeting them through common European debt is impossible because of Hungary’s veto.

4) Meeting them through bilateral grants is impossible because EU deficit and debt levels are too high.

5) Therefore, the reparations loan, the only remaining option, must be approved.

But the argument can easily be reversed. De Wever, after all, argued just last week that his country is being asked to do the “impossible”.

Why not then regard Budapest’s threatened veto as a bluff and infer the necessity of common European debt? Precisely this argument has also been voiced by some EU diplomats.

Opposition intensifies

Faced with this reasoning, many diplomats and officials are hardening their stance. After all, they note, the reparations loan does not technically require Belgium’s support, but legally only the backing of a qualified majority of member states, that is, 15 countries representing 65 percent of the EU population.

Italy, Bulgaria and Malta have now joined Belgium’s concerns, proposing alternative solutions to the lending plan for Ukraine. This development threatens to derail the EU’s objective of reaching an agreement on the so-called “reparations loan”.

According to Euractiv, in a joint statement the four countries expressed support for the European Commission’s proposal for an indefinite freeze of Russian sovereign assets, while warning that this step should not “prejudge” their future use to finance Kyiv’s war effort.

The countries also called on the European Commission and the European Council to seek less risky alternatives, based on the EU’s credit line or temporary solutions to cover Ukraine’s financing needs.

In the same week, Hungary and Belgium warned that the Commission’s decision to invoke Article 122 carries the risk of violating EU law.

Euroclear, Hungary and Belgium have also repeatedly questioned the legality of the lending scheme, out of fear that it could undermine the financial stability of the Eurozone.

The European Central Bank shares the same position.

Europe’s political suicide and the deferral of the problem

Although feasible, the EU almost certainly understands that such a move would ultimately prove self-destructive.

Not only would it permanently inflame anti-European sentiment in one of the Union’s founding and most pro-European members, but alienating the government of the de facto capital of Europe would amount to political suicide.

In essence, the EU would be cannibalizing itself.

It would also create numerous and even more complex legal problems.

The Commission’s proposal effectively obliges private institutions holding Russian sovereign assets to purchase European debt.

Would Euroclear, the Brussels-based financial depository that holds most of these funds, comply if the Belgian government asked it not to do so? And if not, would it be legally obliged to comply?

Let us assume, then, that the EU is not actually so reckless as to proceed without Belgium.

What can we expect next week?

The answer seems unavoidable: almost exactly what happened at the previous summit, and the one before that.

Kyiv’s financing problem will simply be postponed once again.

Of course, EU member states will likely manage to scrape together at least enough money to keep Kyiv afloat through 2026, or at worst through the second quarter of the following year.

As at the previous summit, they will then proudly declare that they will continue to support Ukraine “for as long as it takes”, without explaining how.

Those EU countries unwilling to reach into their pockets will defend their decision by blaming Belgian, or Hungarian, intransigence.

Belgium, for its part, will argue that the prospect of an imminent end to the war means it cannot support such a risky plan to keep Ukraine economically alive.

What it will not mention, however, is that its refusal to back the loan makes the prospect of ending the war even more likely.

The belief, or the hope, that the war may end soon may thus prove self-fulfilling.

Ursula… Karenina

However, Belgium alone will not bear responsibility for this almost inevitable disaster.

The root of the EU’s problem runs far deeper, and wider.

EU leaders, afraid to ask their citizens to pay for supporting Kyiv at a time of growing economic insecurity, and as anti-Russian sentiment no longer resonates broadly within societies, stubbornly cling to two core principles that push the Union ever faster toward the political edge of the cliff: they want to continue supporting Ukraine, while at the same time refusing to ask European citizens to keep paying for it.

The inevitable tragedy of holding two incompatible desires is, of course, something Tolstoy’s most famous heroine understood instinctively.

“I cannot have both together, and that is all I want,” Anna Karenina says, referring to her son Seryozha and her lover Vronsky.

“And it will end in one way or another, and so I cannot, I do not like to talk about it.”

Anna, of course, ultimately takes her own life by jumping in front of a train.

Unfortunately, it increasingly appears that Europe may soon meet a similar fate, perhaps as early as next week.

The European Council has introduced a regime of indefinite freezing of Russian sovereign assets, allowing Brussels to stop renewing the measure every six months.

By itself, an indefinite freeze does not constitute final confiscation, however Europe intends to discuss the mechanism for seizing the assets at the upcoming summit on 18–19 December.

Russia’s lethal weapons

Nevertheless, Russia possesses a wide range of effective countermeasures, including those related to intellectual property.

The Council of the European Union approved a provision banning the return of frozen Russian sovereign assets, without specifying a timetable or procedures for their release.

The wording of the document indicates the indefinite nature of the freeze.

Until now, the EU was obliged to extend the measure every six months, which required the consent of all member states.

From now on, the EU will no longer need to take into account the views of Hungary and Slovakia, which openly oppose financial and military support for Ukraine.

To this end, an emergency powers clause was added under Article 122 of the Treaty on the Functioning of the European Union.

In practice, the existing rules requiring unanimous confirmation of sanctions every six months were revised.

From now on, decisions will be taken by qualified majority, 15 rather than all 27 member states, and individual countries will no longer be able to block the extension of sanctions.

The official announcement states that “direct or indirect transfers of assets or reserves of the Central Bank of Russia, as well as of legal entities acting on its behalf, are prohibited until the risk of deterioration of the economic situation in the European Union is eliminated.”

EU leadership, including the heads of the European Council, the European Commission and European diplomacy, António Costa, Ursula von der Leyen and Kaja Kallas, described the decision as an “indefinite freeze” and did not clarify the details of any potential return of the funds to Russia.

The document approved by the EU Council notes that the decision constitutes the first step toward confiscation of the funds under the pretext of the “reparations loan” scheme for the future financing of Ukraine in the period 2026–2027.

The gamblers and the cost

In response to the actions of the European Council, the spokesperson of the Russian Ministry of Foreign Affairs, Maria Zakharova, described EU authorities as “gamblers” and reminded von der Leyen that it is not Russia, but the EU itself, that directly bears the economic cost of the ongoing confrontation.

“Judging by the statistics, the cost for EU countries is steadily increasing. And what messages does Ursula send them, and for what reason does she punish them? A joke, of course,” she wrote on her Telegram channel.

President Vladimir Putin had previously stressed that the confiscation of Russian sovereign assets would constitute a clear “act of theft”.

The Russian leadership has already prepared several response scenarios in the event of asset seizure. This week, the Central Bank of Russia announced its decision to file a lawsuit against the Belgian depository Euroclear, which holds the largest share of Russian reserves, amounting to approximately €210 billion.

Experts assess that the indefinite freezing of Russian assets does not amount to final confiscation and lacks a solid basis in international law.

Moreover, Moscow has several response options. At the same time, current developments will not affect future peace or negotiation processes between Russia, the West and Ukraine.

“The ban on returning frozen Russian sovereign assets does not constitute final confiscation, even without release mechanisms. We are playing a complex diplomatic game with the European Union, which simply cannot make such decisions from the standpoint of international law,” estimates economist Vasily Koltashov.

According to him, Russia has several possible countermeasures, including the recognition of the European Union as an extremist organization, as had been temporarily applied in the past in the case of the Taliban movement.

Among the retaliatory measures, the confiscation of remaining Western assets cannot be ruled out, including companies, real estate and intellectual property.

He argues that confiscation should not be limited to trademarks, but that everything related to products and production technologies should be made available for copying on a legal basis.

According to him, the ultimate point could be the full liberalization of Western intellectual property in Russia.

Koltashov stresses that the ban on returning frozen assets will not affect the long-term functioning of the Russian financial market and economy, but will merely add an element of pressure on market participants.

In his view, the situation surrounding the freezing of Russian sovereign assets makes the European Union less attractive for investment, reduces the trust of third-country central banks in holding assets within EU jurisdictions, and undermines the status of the euro as a reserve currency.

Stanislav Tkachenko, Professor of European Studies at the School of International Relations of Saint Petersburg State University and a member of the Valdai Club think tank, noted that European actions regarding Russian assets do not constitute a “point of no return”. According to him, developments are being closely monitored by BRICS countries and the Global South, a fact that is causing strong displeasure to US President Donald Trump.

Finally, he warned that if the European Union continues efforts to confiscate Russian assets, the consequences for European finances will be severe, with credit rating downgrades and the relocation of international financial institutions outside Europe.

Anna Karenina met a tragic end because she could not reconcile her desires with reality.

The same applies to Europe.

www.bankingnews.gr

Σχόλια αναγνωστών