The reshaping of the global monetary system is happening, one gold bar at a time.

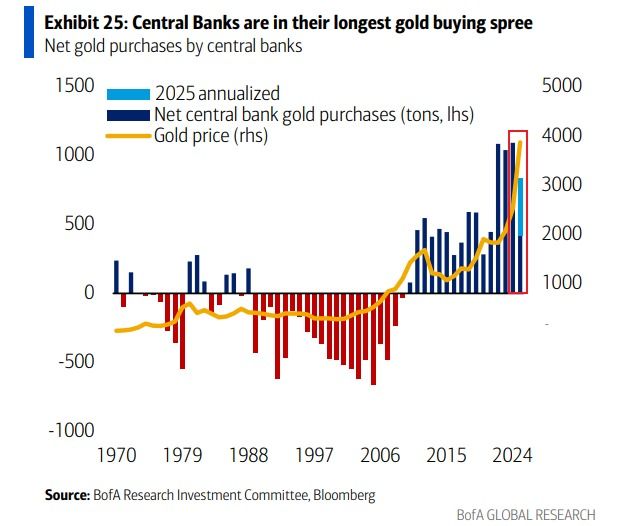

Between 2022 and 2024, central banks purchased over 3,000 tons of physical gold, likely the most intense period of accumulation of the precious metal since the 1970s.

This is not nostalgia for the Bretton Woods era, but a reaction to geopolitical fragmentation, where nations prioritize control over their future monetary standing rather than dependence on foreign governments.

Three factors are driving this transition:

1) Abrupt purchases by institutional players,

2) Geological constraints on new supply,

3) Regulatory frameworks pushing gold trade into unconventional channels.

A recent report by Ubuntu Tribe examines these dynamics and their impact on the evolution of money, sovereignty, and payment system infrastructure.

The “geography of trust” is changing

The numbers tell a specific story.

Central banks have exceeded the 1,000-ton threshold for three consecutive years:

1,136 tons in 2022,

1,037 in 2023,

and 1,045 in 2024.

But volume alone doesn’t fully capture the shift, many of these buyers are moving their reserves from the vaults of New York and London back to their own countries.

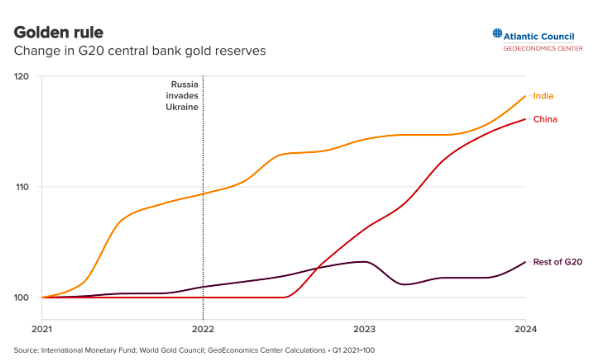

China, Turkey, and Poland increased their reserves while insisting on domestic storage, according to the World Gold Council.

In Europe, repatriation programs have brought hundreds of tons back to Germany, the Netherlands, Austria, and Poland.

The message is clear: nations are seeking fewer jurisdictional dependencies and greater control during times of political tension. This movement concerns not only ownership but also custody, accessibility, and monetary sovereignty in times of crisis.

Mining cannot keep up with demand

Although demand is increasing, supply remains constrained.

Global mine production reached 3,661 tons in 2024, approaching previous highs despite rising prices.

The “bottleneck” in the supply chain is not due to intensity but to geopolitical factors, capital intensity, and permitting delays.

From the discovery of a new deposit to the start of production requires 16 to 18 years, far beyond typical political horizons.

Declining ore grades require more capital and energy per ounce, while environmental regulations (ESG) extend permitting timelines.

Recycled gold added 1,144 tons in 2022, a valuable contribution, but only about one-third of the mined quantity.

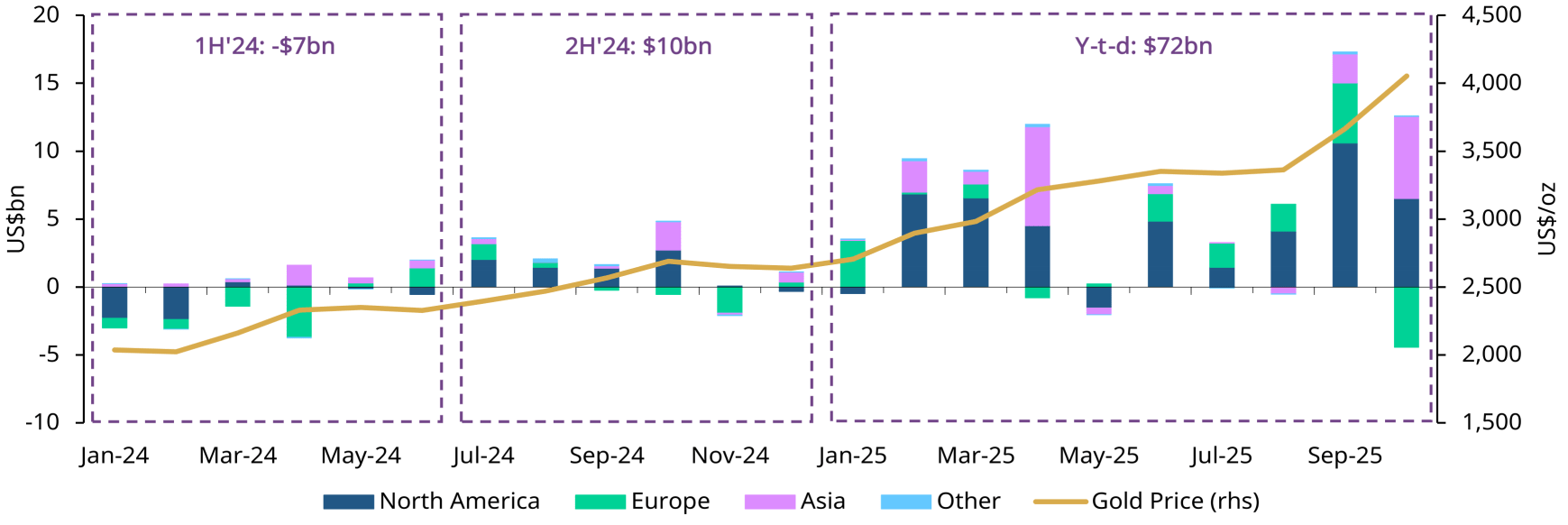

The gap between rising institutional demand and limited supply creates persistent upward pressure on prices, which cannot be resolved through short-term adjustments.

South Africa is a prime example: once a dominant producer, it now contributes a small share of global output, showing how historic mining hubs lose influence as their deposits deplete.

Infrastructure constraints and monetary risks

Refining facilities in Switzerland, which process the majority of the world’s gold, now operate at the limits of their capacity as cross-border transactions intensify.

What was once a technical issue, refining rates, bar standardization, air transport, has become a factor of monetary policy.

When refining capacity tightens, price discrepancies emerge.

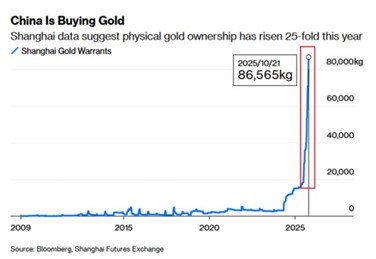

In the third quarter of 2024, gold prices in Shanghai were 25 USD/ounce higher than international benchmarks, reflecting a physical shortage that markets could not smooth out.

These supply-chain bottlenecks now affect monetary conditions as much as interest rates or reserve indices.

If geopolitical events were to disrupt refining in Switzerland, chaos could dominate the global gold settlement system, despite adequate reserves.

Regulatory frameworks create shadow markets

Well-intentioned compliance measures have unintended consequences.

Stricter banking requirements for gold transactions exclude small miners from official financial channels, pushing trade into underground routes.

In 2022 alone, at least 435 tons left Africa unreported, over 10% of global production.

These conditions fuel parallel markets where the metal’s origin is unverifiable and legitimate activity blurs with illicit trade.

The problem of “fractional gold”

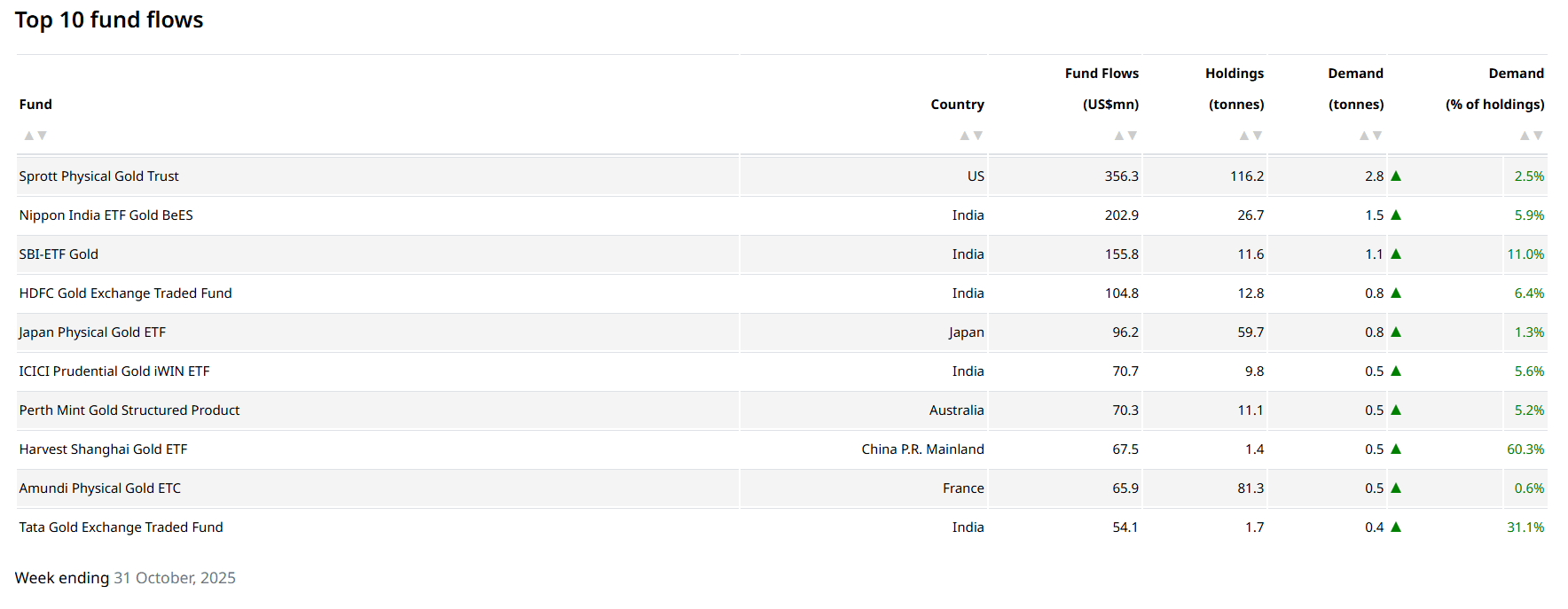

Gold derivatives, futures contracts, ETFs, and unallocated accounts, provide liquidity and hedging mechanisms but introduce counterparty risk that disappears when physical delivery is requested.

In December 2024, open interest in the COMEX market reached 52 million ounces, while available stocks were only 3.2 million, that is, over 16 claims per available ounce.

The London market has a ratio of 7:1 to 9:1.

This fractional structure resembles reserve banking, operating smoothly until delivery requests rise, then the difference between a “claim” and a specific bar becomes critical.

As policymakers and central bankers emphasize settlement in physical quantities, allocated custody (where bars are identified and segregated) gains added value.

The Shanghai price divergence from derivative prices in 2024 made this distinction clear: futures contracts could not meet physical gold demand.

Monetary policy and physical realities

These structural pressures are reshaping central bank decision-making on three critical levels:

1) Composition of foreign exchange reserves has become a strategic doctrine. The choice between gold and foreign-currency bonds is no longer neutral, it is a statement on exposure to sanctions, settlement autonomy, and monetary/economic independence.

2) Microstructural frictions (refining, storage, movement of safeguarded quantities) affect macroeconomic outcomes. Authorities that ignore these physical parameters, focusing solely on price indices, overlook crucial transmission channels.

3) Regulatory gaps undermine policy effectiveness. When 10% of production moves through shadow markets, both transparency and anti–money laundering efforts are threatened.

An ancient asset on digital rails

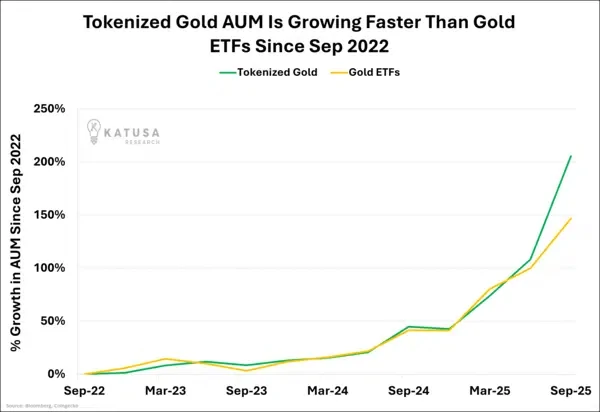

Digitization (tokenization) offers a modern path for the market that preserves gold’s properties while reducing frictions.

When based on physical, vaulted gold, with transparent real-time audits and immutable redemption rights, it combines physical security with digital transparency.

This is critical for cross-border transactions in a fragmented geopolitical landscape.

Digital gold can be used to settle transactions without banking intermediation, operate beyond state jurisdictions, and offer transparency that traditional custody systems often lack.

By October 2025, tokenized/digitized gold markets had surpassed 3 billion USD.

Standard-setting bodies are developing frameworks to integrate this technology into regulated markets, emphasizing efficiency and sound governance.

For smaller institutional investors and households, tokenization democratizes access through fractional ownership and lower minimum investments.

For policymakers, it offers a tool to strengthen monetary sovereignty without sacrificing international transactional capacity.

The technical requirements are clear: transparent disclosure, independent auditing, legal clarity of ownership, protection in cases of insolvency, and regulatory frameworks that manage custodial risk without stifling innovation.

The return of real money

Monetary policy will inevitably respond to these realities, whether central bankers acknowledge them or not.

The shift toward gold is not a romantic nostalgia, but a preference for settlement finality in transactions during an era of heightened counterparty risk.

As geopolitical fragmentation deepens, the premium on assets that trade without intermediaries increases.

The renaissance of gold signals a fundamental realignment: in an era of contested monetary sovereignty and strained financial infrastructure, the world’s oldest monetary technology proves, once again, to be surprisingly modern.

www.bankingnews.gr

Σχόλια αναγνωστών