From time to time, a leader says out loud what normally remains unspoken and, in doing so, exposes a deep and dangerous vulnerability that the entire system had been trying to conceal.

At the World Economic Forum in Davos, President Donald Trump did exactly that.

In an interview with Maria Bartiromo on Fox Business, when asked about the possibility that European countries might respond to his now withdrawn threats of tariffs by selling their vast holdings of American assets, President Trump issued a striking and unprecedented threat.

If they do it, they do it. But you know, if that happens, there will be major retaliation from our side. And we hold all the cards.

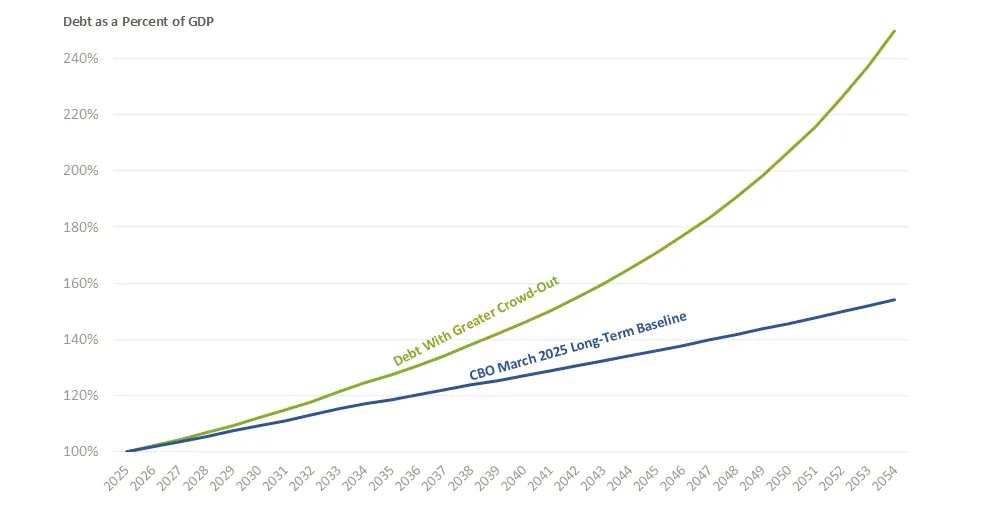

United States debt out of control

Extreme fragility of the United States financial system

The President of the United States, on the international stage, is openly threatening America’s closest allies not to sell the very public debt of the American government.

This is not the language of a confident creditor who holds all the cards.

It resembles the language of a desperate debtor, trembling at the thought of what will happen when his largest creditors head for the exit.

President Trump’s threat is not an act of strength. It is a profound admission of weakness.

It is a public acknowledgment that the United States Treasury market, the foundation of the global financial system, is in a state of extreme fragility.

And it is the loudest alarm bell to date that a sovereign debt crisis is no longer a distant possibility but an immediate and inevitable reality.

You must understand that when the President of the United States publicly threatens America’s closest allies not to sell American sovereign debt, he is not speaking from a position of strength. He is exposing a deep and terrifying weakness at the heart of the global financial system.

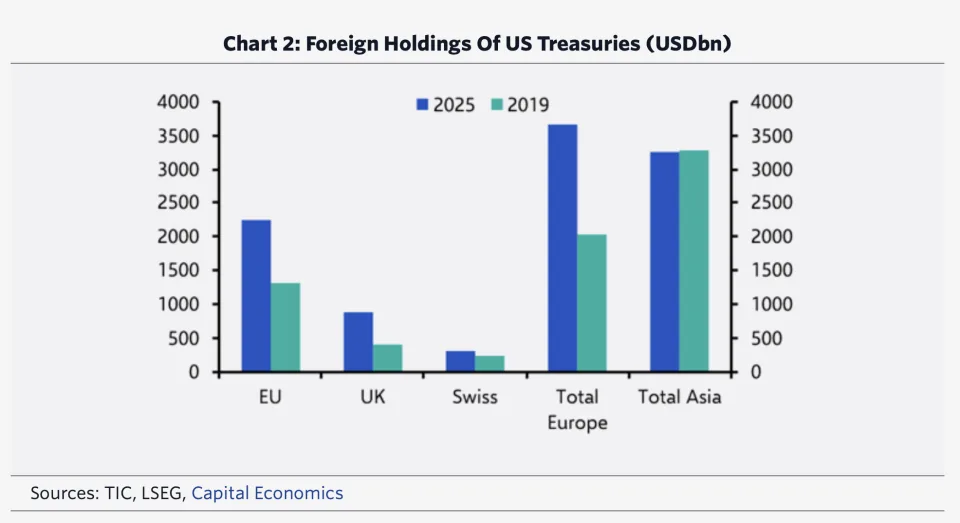

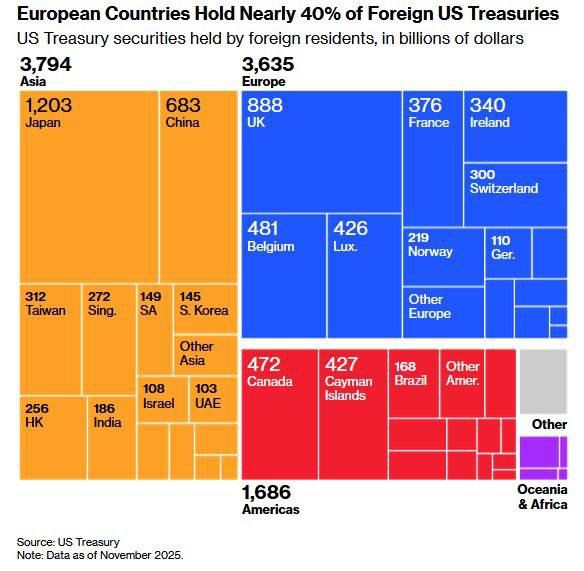

It should be noted that China has reduced its holdings of United States bonds from 1.3 trillion dollars to just 682.6 billion dollars, a 17 year low, that Japan is facing a bond market crisis that will force it to sell part of the 1.2 trillion dollars it holds in Treasuries, and that Russia has exited permanently after its reserves were seized. It appears that the traditional buyer base of American debt has collapsed.

You must understand that Europe has been left as the last major buyer, accounting for 80% of all foreign purchases of United States Treasuries from April to November 2025, and that Trump’s threat is a desperate attempt to prevent them from heading for the exit.

Pension funds are leaving Europe

A revealing report by Reuters last week disclosed that major Scandinavian pension funds, among the largest and most conservative investors in the world, are already selling their American bonds, citing rising geopolitical risk and concerns over unsustainable United States debt, and that this is only the beginning of a broader European exodus.

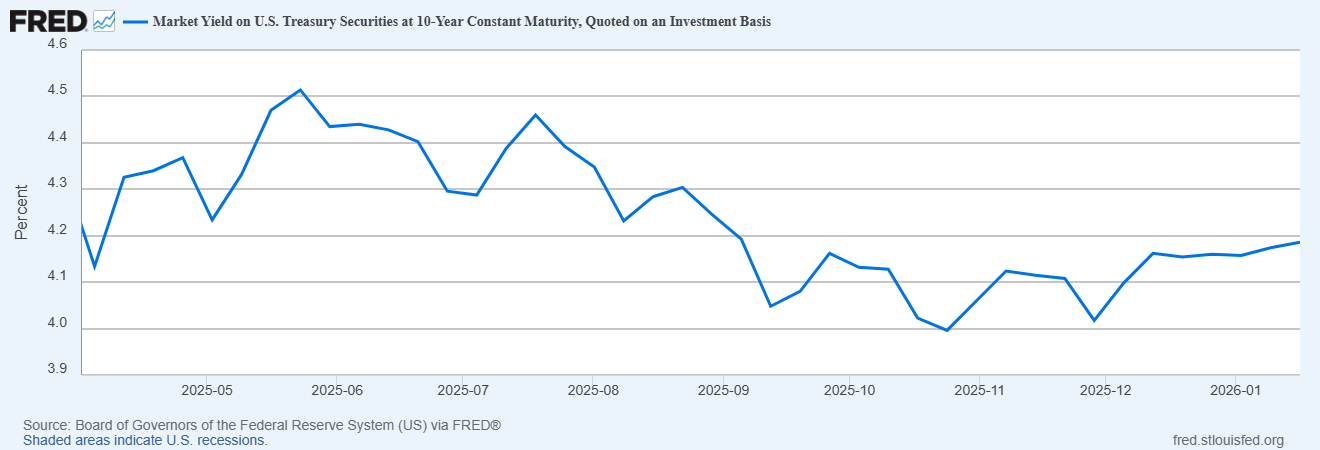

The United States must issue 11 to 12 trillion dollars of new debt in 2026 to refinance maturing bonds and cover its deficit, and with traditional buyers having vanished, the Federal Reserve will be mathematically forced to monetize this debt through massive money printing.

When the Fed is compelled to unleash a new wave of quantitative easing to absorb debt that no one else wants, this will likely trigger a massive capital flight from the 100 trillion dollar global bond market into the tiny 2 to 3 trillion dollar precious metals market, creating a snowball of biblical proportions.

And now the question is the following. Does President Trump’s threat in Davos toward Europe reveal that the United States Treasury market is in crisis.

Let us delve into the following.

It is becoming increasingly clear that the buyer base of American Treasuries is collapsing.

For decades, the United States could run massive deficits and finance its state through reckless issuance of government bonds because it always had a reliable and captive group of foreign buyers.

These buyers, mainly large exporting countries such as Japan and China, as well as oil producing states of the Middle East, needed a safe and liquid place to park the trillions of dollars they accumulated through trade.

They recycled their trade surpluses back into American bonds, creating a symbiotic relationship that allowed the United States to live beyond its means and the rest of the world to hold a stable reserve asset.

Why this era has now ended and the traditional buyer base of American debt has collapsed.

As the cracks appear, Scandinavian pension funds are leading the exit.

As if President Trump’s public threat were not enough to confirm the crisis, the Reuters report provides concrete, real time evidence that the European flight from American assets is already underway.

According to it, large pension funds in Sweden, Denmark and Finland are actively reassessing their exposure to American assets, citing geopolitical tensions, rising debt and policy uncertainty. And this is critical. These are not speculative hedge funds. They are the largest, most conservative, long term investors in the world, and all of them are concerned.

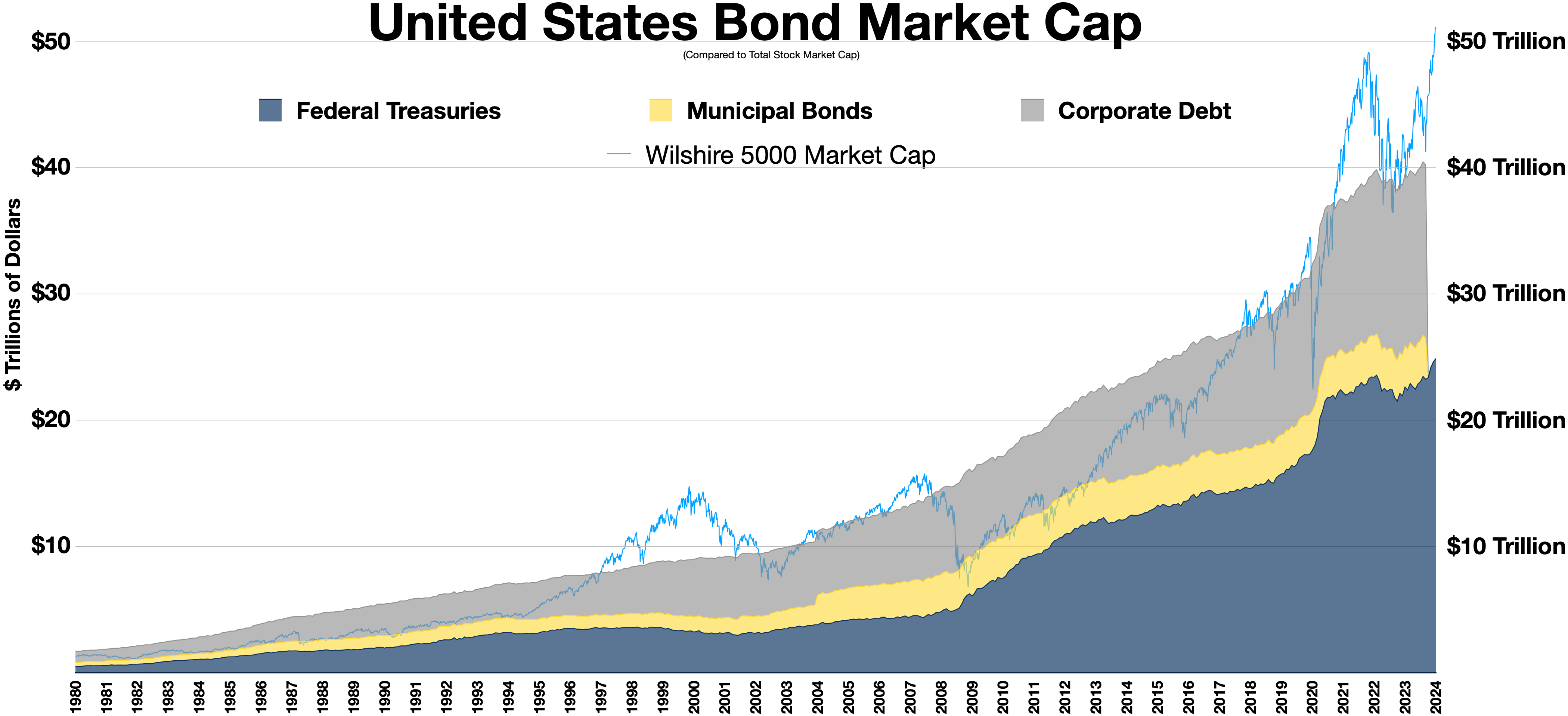

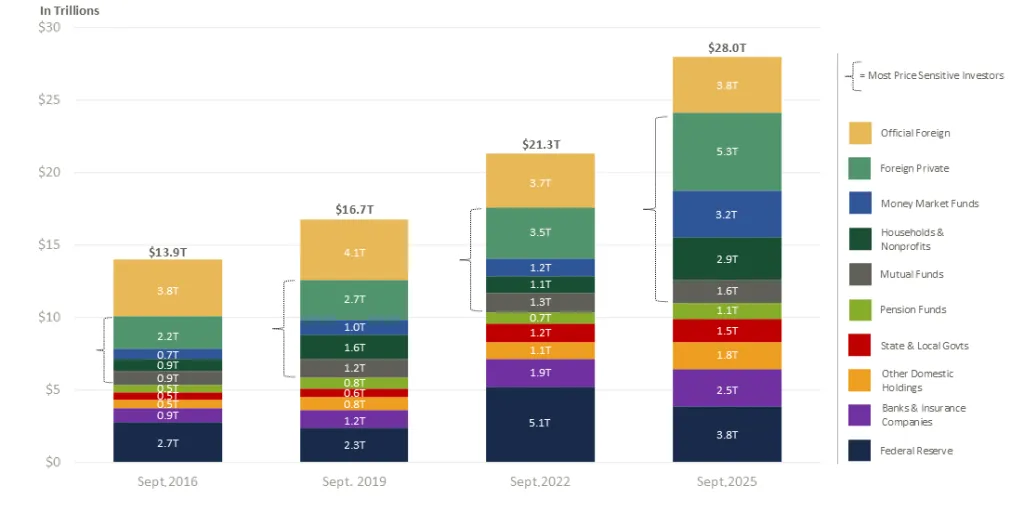

Holders of American bonds

The structure of United States debt

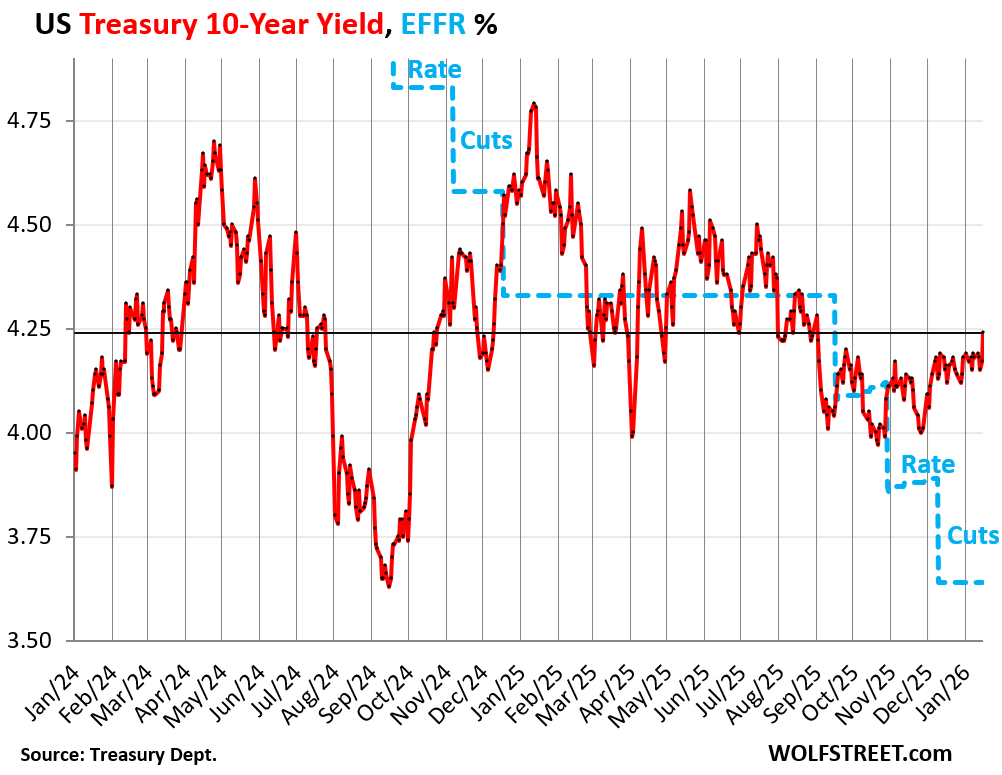

Investors around the world cannot overlook America’s 12 trillion dollar problem.

The collapse of the foreign buyer base is occurring at the worst possible time for the United States.

The American state faces an unprecedented funding crisis in 2026.

It must refinance approximately 9 trillion dollars of maturing debt while running a fiscal deficit projected to range between 2 and 3 trillion dollars.

This means that the United States Treasury will have to issue an astronomical 11 to 12 trillion dollars of new debt in a single year, and the world knows it.

This is not an academic exercise. It is the beginning of a major capital flight from American assets, led by some of the most sophisticated and conservative investors on the planet.

The snowball is approaching. And here the story comes full circle.

The global bond market is the largest financial market in the world, with more than 100 trillion dollars in assets.

For decades, it has been the ultimate safe haven for conservative capital.

But this is about to change.

When the Fed is forced to monetize the debt and the sovereign debt crisis that is already swallowing Japan and threatening Europe finally reaches American shores, where will the capital of those 100 trillion dollars go.

Where will that capital flee when the ultimate safe haven is revealed to be the very source of risk.

There is only one answer. Precious metals. And they are already showing us that this is the destination.

And now the trigger has been pulled.

President Trump’s threat in Davos was not a policy announcement. It was a confession.

It was the moment the world learned that the United States Treasury market, the foundation of the global financial system for more than a century, is in crisis.

The traditional buyers are gone. And the imminent black swan is coming.

www.bankingnews.gr

Σχόλια αναγνωστών