In 2025, precious metal prices rose sharply, with the price of silver recently surging above 80 dollars per ounce.

Naturally, every time precious metals rise, the same group of commentators appears to proclaim that a financial collapse is underway.

Articles such as those published in financial media by commentators argue that such price movements signal far more than a simple market rally.

They claim that we are in the early stages of the collapse of fiat currencies and a systemic crash.

These narratives are often based on the assumption that sharp rises in precious metals reflect a mass flight from fiat currencies toward real money.

They argue that this behavior foreshadows delivery defaults in futures contracts, a collapse of confidence in exchanges and ultimately a repricing of metals at extreme valuations, such as 200 dollars for silver and 10,000 dollars for gold.

However, the data behind these dramatic forecasts do not support the narrative, but only part of it.

For example, the World Gold Council reported in Q2 2025 that total gold demand reached 1.249 tons, up 7% year on year, while mining production increased only marginally.

This is a supply problem

Silver also recorded stronger industrial and investment demand, such as in EVs and photovoltaics, but according to the Parkview Group, demand in green energy applications, not retail market stockpiles, remains the primary driver of prices.

The critical point here is that these movements are significant, but they are not unprecedented, at least so far.

What commodity pricing depends on

It is a function of supply and demand in commodity markets.

Explosive price increases, however, are a different matter.

The pricing of all commodities, and especially precious metals, is ultimately determined in derivatives markets.

These operate mainly through COMEX and CME.

In the long term, physical demand does indeed influence prices.

In the short term, however, prices are determined by futures contracts, where buyers and sellers speculate, hedge risks or engage in arbitrage.

Given that the overwhelming majority of these contracts are settled in cash, without physical delivery, prices are influenced more by the volume and positioning of financial participants than by immediate physical shortages.

This structure allows large institutions, hedge funds and algorithmic traders to influence price direction through leverage, often independently of real physical flows.

Naturally, two main factors drive speculators into precious metals markets.

The first is the narrative itself.

When prices rise, this often coincides with periods of uncertainty, such as when the Federal Reserve signals interest rate cuts, when real yields decline or when geopolitical tensions increase.

The self fulfilling prophecy

None of these conditions implies systemic collapse, but the narrative attracts institutional investors.

The second factor is price momentum.

As prices rise, the narrative strengthens and traders chase the move, creating a self reinforcing cycle that continues until it breaks.

Such phenomena have been observed repeatedly in the history of silver and each time were followed by a sharp correction.

Another issue is actual supply and demand.

Silver, for example, plays a critical role in industrial production, electronics, photovoltaics and the automotive industry.

When prices rise sharply, costs for manufacturers increase, are passed on to consumers and ultimately constrain demand.

This reduces industrial demand for silver, while at the same time high prices encourage increased production from mines.

In other words:

The cure for high prices is high prices.

Finally, the markets themselves impose limits.

When prices surge, COMEX and CME raise margin requirements to reduce systemic risk.

Despite claims of manipulation, this is a fundamental stabilization mechanism.

As early as the beginning of December, the CME has raised margin requirements more than once, as had happened in 2011 before the mean reversion of prices.

Margin is the collateral deposit capital that an investor must have to open or maintain a position in futures or other derivatives.

It is not the cost of purchase, but security to cover potential losses.

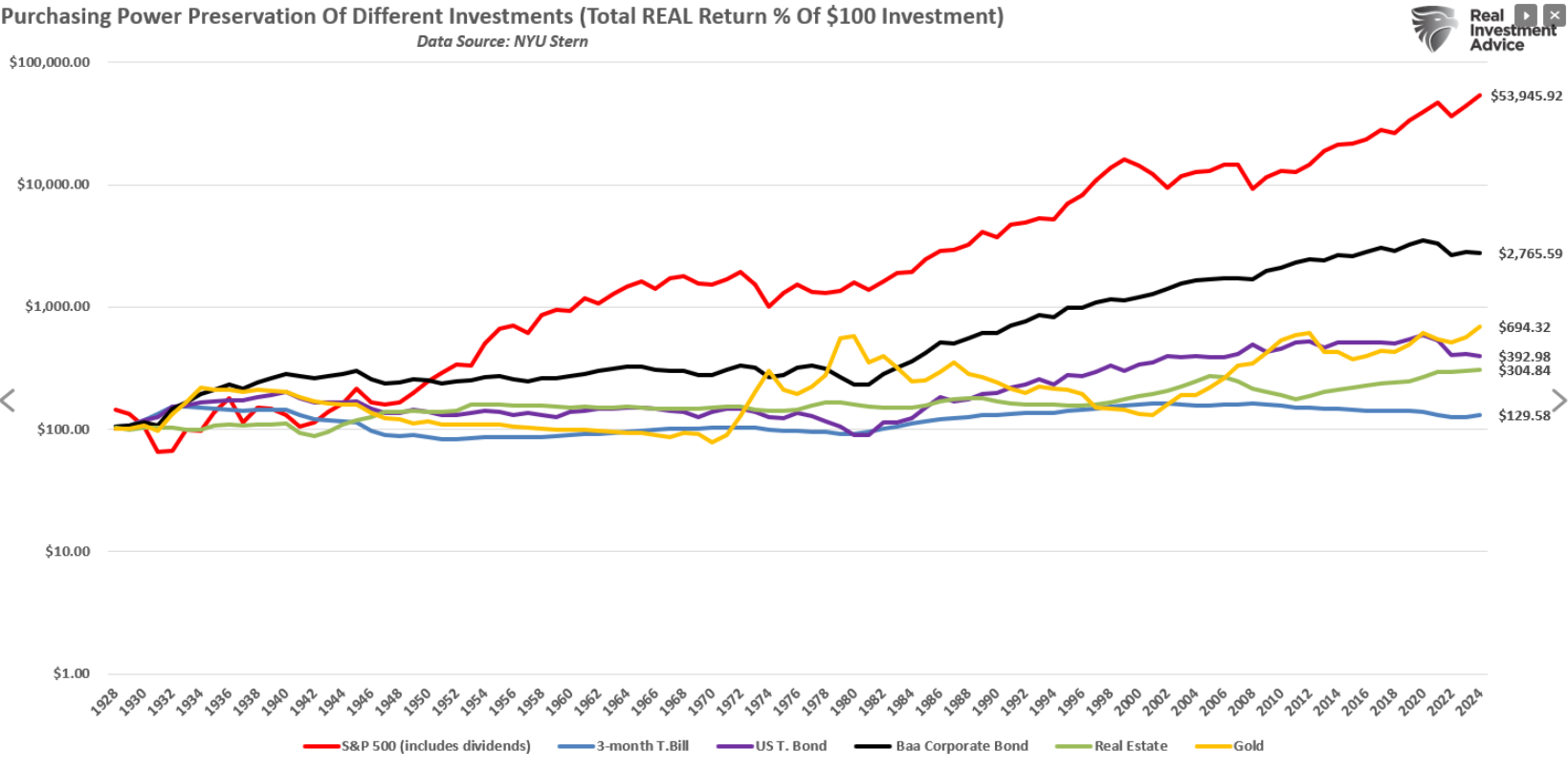

As for claims of a collapse of fiat currencies, there is no evidence to support them.

If such a collapse were occurring, yields on United States government bonds would be surging, rather than posting a positive total return in 2025, although recent developments do not point to positive trends.

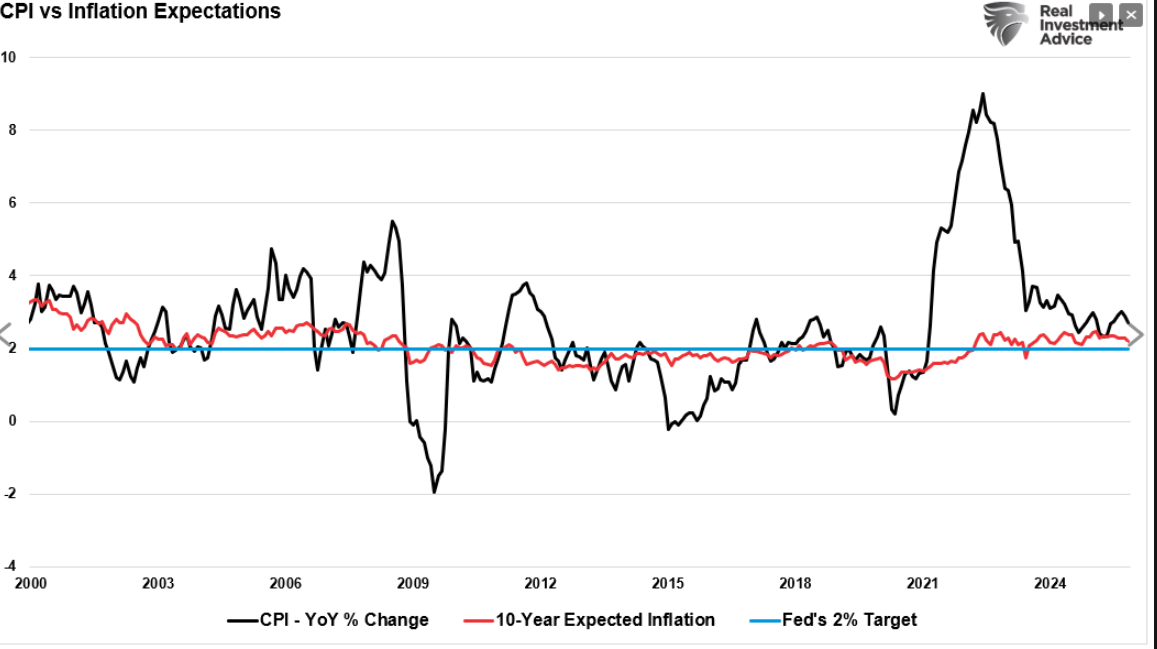

Inflation and inflation expectations also do not indicate a collapse of confidence in the dollar.

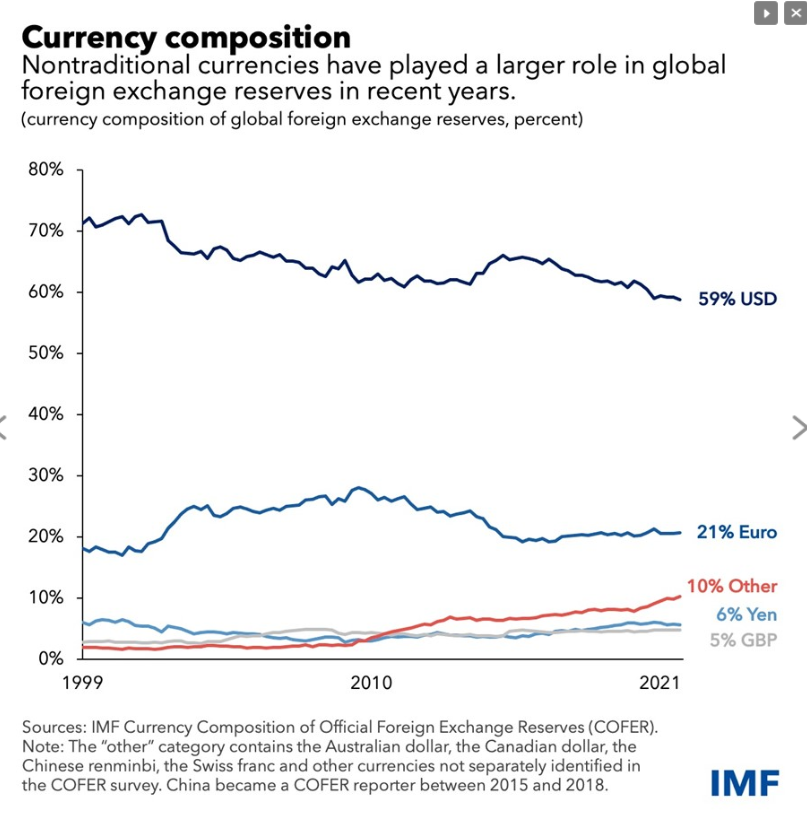

The reality is that the dollar remains the global reserve currency, while the euro and the yen continue to function normally, for now.

Extreme forecasts of 200 dollar silver and 10,000 dollar gold are not supported by supply and demand fundamentals and would require a monetary event of unprecedented magnitude, for which today there are only indications.

We could not bet that it is impossible.

www.bankingnews.gr

Σχόλια αναγνωστών