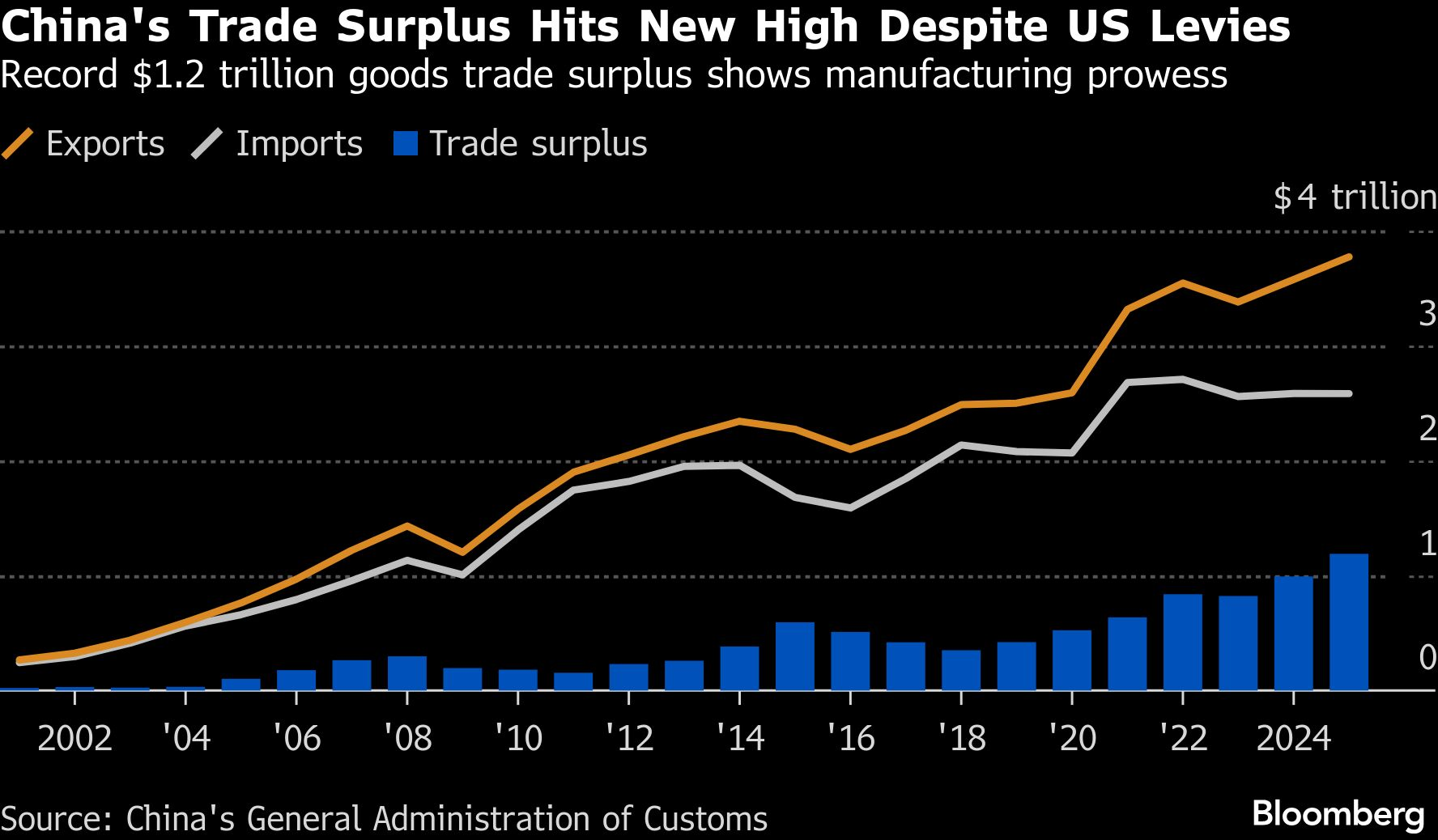

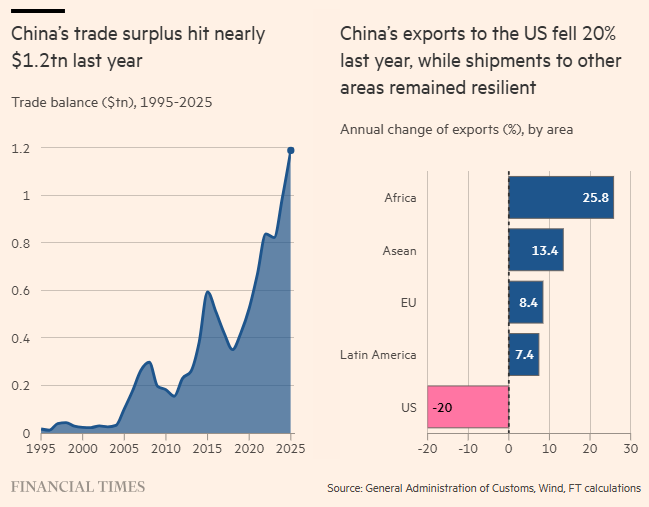

China’s trade surplus surged to a historic high in 2025, even despite the fact that United States President Donald Trump, in his second term, launched a new round of trade war with tariffs against the country last April. China’s total exports increased by 5.5% year on year and reached 3.77 trillion dollars in 2025, while imports remained flat at 2.58 trillion dollars, according to the General Administration of Customs. The trade surplus amounted to 1.19 trillion dollars in 2025, up from 992 billion dollars in 2024. However, data released by the People’s Bank of China on January 7 showed that the country’s foreign exchange reserves increased by only 160 billion dollars, reaching 3.36 trillion dollars at the end of December 2025 compared with a year earlier.

What happened to the foreign exchange reserves

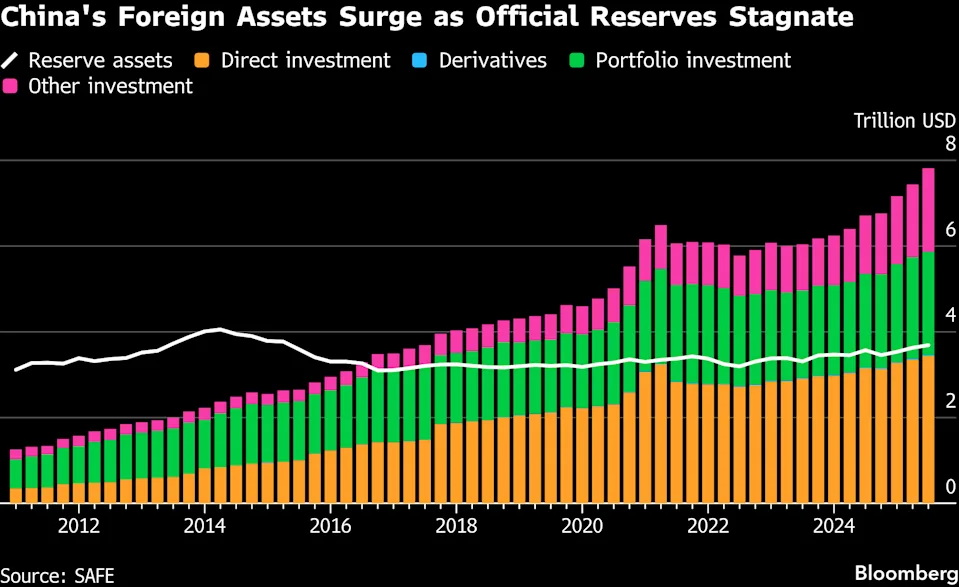

This means that only 13% of the reported massive trade surplus flowed into China in 2025. Foreign exchange reserves have largely fluctuated between 3.01 and 3.33 trillion dollars over the past decade. “There are several reasons why only a small portion of China’s trade surplus translated into higher foreign exchange reserves,” says an economic columnist based in Beijing. “For example, the 992 billion dollar trade surplus in 2024 was not fully collected in dollars. Most of it was settled in yuan and other currencies, which means that the actual increase in dollar reserves may have been around 200 billion dollars.”

The internationalization of the yuan

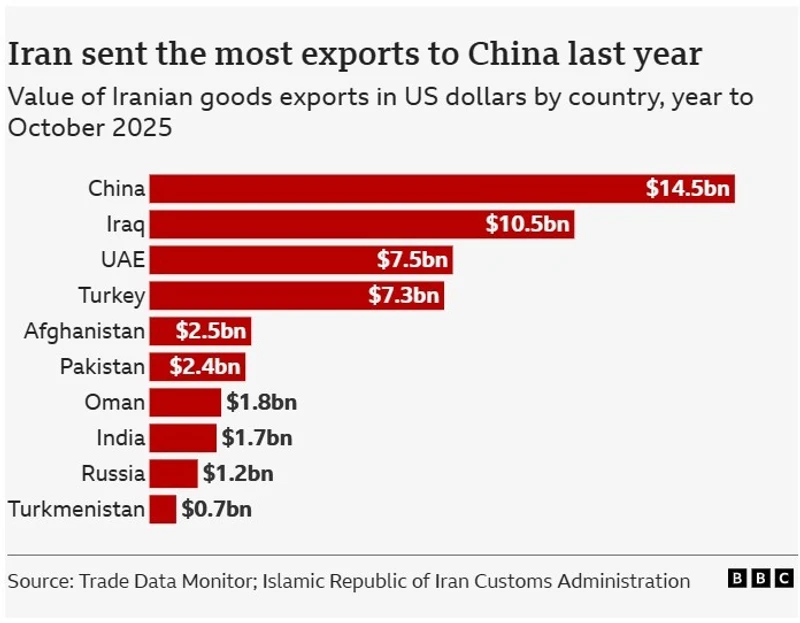

He adds that spending by Chinese tourists and students abroad, profit remittances from foreign companies operating in China, and overseas investments by Chinese state owned enterprises (SOEs) have put pressure on the foreign exchange reserve balance. It is no secret that Chinese SOEs have for years been using yuan to purchase crude oil from countries under sanctions, such as Venezuela, Iran, and Russia, as well as minerals from certain African countries. These countries can use the currency to buy Chinese products or convert it into international currencies in Hong Kong. A Chinese analyst is quoted as saying that, amid the recent political turmoil in Venezuela and the growing social unrest in Iran, Beijing will need to fine tune its yuan internationalization plan with greater precision. Pressure may intensify after Trump stated on Monday January 12 that countries trading with Iran would face a new 25% tariff, a move that could make Chinese products significantly more expensive in the United States, given the strong trade ties between China and Iran.

Manufactured export data – Factories leave China

In reality, the historically high trade surplus runs counter to the widespread perception that many industries are leaving China for Southeast Asia, including Vietnam, Thailand, and Indonesia, leaving large numbers of factory workers unemployed. Some commentators abroad argued that China’s export data may be artificially inflated. They claimed that some companies purchased invoices to create fictitious export records and claim tax rebates. In one case, a company in Liaoning province presented fake export transactions to illegally obtain tax rebates of 212 million yuan, 30 million dollars. Another case was uncovered in July 2024, when police in Wuhan announced that they dismantled an export tax rebate fraud ring involving a small supply chain company that fabricated false export data linked to offshore shipments worth more than 200 million yuan and claimed around 27 million yuan in rebates using fake invoices.

30% of China’s steel exports in 2023 and 2024

A commentary published by the Shanghai Metals Market, a Shanghai based news outlet specializing in non ferrous metals trading, stated that exports based on fake invoices accounted for around 30% of China’s steel exports in 2023 and 2024. It remains unclear to what extent these cases have distorted China’s trade statistics, as the government has not released a comprehensive nationwide assessment covering all such illegal activities. In March of last year, the central government introduced a new set of rules to crack down on these practices, which came into effect on October 1, 2025.

Pessimistic outlook

Wang Jun, deputy head of the General Administration of Customs, said at a media briefing on Wednesday January 14, 2025 that China’s trade performance last year was supported by a combination of policy support, domestic demand, and industrial strength. He said that the key factors behind the strong trade growth last year included:

1) Policy support: Central and local governments implemented targeted measures to help exporters secure orders and expand markets. Customs authorities piloted 29 trade facilitation policies, which are now being rolled out nationwide, helping to absorb external shocks.

2) Domestic market demand: China’s large consumer base supported import demand as the economy recovered. In the first three quarters, China was the main export destination for 79 countries and regions, with full year imports reaching 18.48 trillion yuan, about 10% of the global total.

3) Industrial strength: China’s complete industrial system and integrated supply chains supported export growth. Exports of industrial goods have increased for nine consecutive years, led by capital equipment, which accounted for nearly 60% of total exports.

Wang warned that “the momentum of global trade is weakening as economic growth slows, geopolitical tensions persist, uncertainty remains high, and the cost of trade transactions continues to rise.” He added that international organizations have downgraded their forecasts for global trade and that growth in global goods trade is expected to remain weak in 2026.

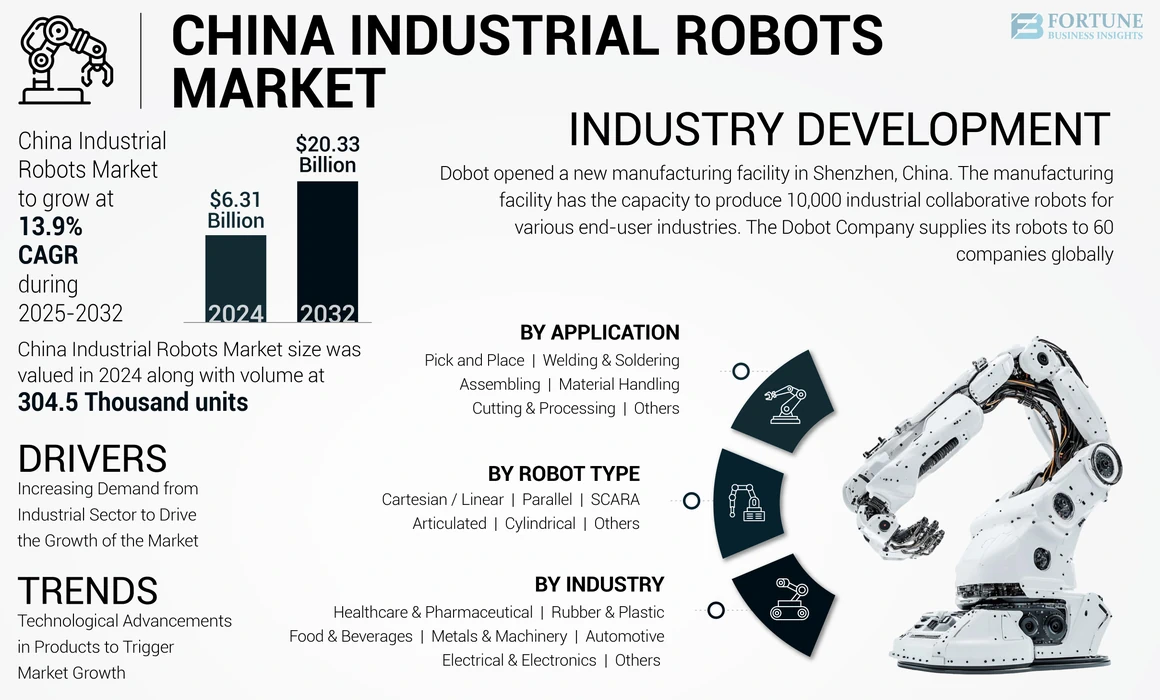

The boom in industrial robots – Responding with automation

Nevertheless, Wang said that China will be able to withstand adverse geopolitical headwinds, citing the country’s institutional advantages, large domestic market, complete industrial system, and deep pool of skilled workers. He added that exports of high technology products increased by 13.2% year on year, contributing 2.4 percentage points to overall export growth. He also stated that exports of industrial robots exceeded imports for the year, making China a net exporter of such products for the first time. At the Consumer Electronics Show (CES) 2026 in Las Vegas, from January 4 to January 9, humanoid robots emerged as one of the most striking categories, with Chinese companies dominating the sector. Official CES data showed that 21 of the 38 exhibitors presenting humanoid robots came from China, giving the country more than half of the global presence in this segment and highlighting the rapid commercialization of its innovation in the field of robotics.

www.bankingnews.gr

Σχόλια αναγνωστών