There is a chart that should terrify every investor, every policymaker and every citizen in the world.

It reveals the single greatest threat to the global financial system, a threat so enormous and so immediate that it makes the crisis of 2008 look like a minor disturbance.

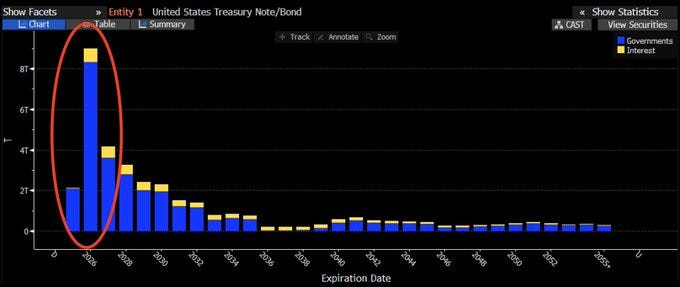

This is the “maturity wall” of United States Treasury debt and it is a fiscal time bomb ready to explode in 2026 and if it is not repaid with part of the revenues from tariffs, as Trump claims, prepare yourselves for unprecedented upheavals.

This concerns more than 9 trillion dollars of American sovereign debt maturing in 2026. Not 2030. Not 2040. But 2026.

And every dollar of this debt, which was issued in an environment of nearly zero interest rates, must now be refinanced in an interest rate environment of 3.5–4%.

This is not a long term fiscal challenge.

This is a sudden, structural crisis that will strike the global financial system with the force of an iron bar used to demolish buildings.

In simple terms, the United States government engaged in a massive borrowing orgy when money was cheap.

Now, the bill has arrived and it must be paid with much more expensive money.

The consequences are not theoretical, they are coming with mathematical certainty.

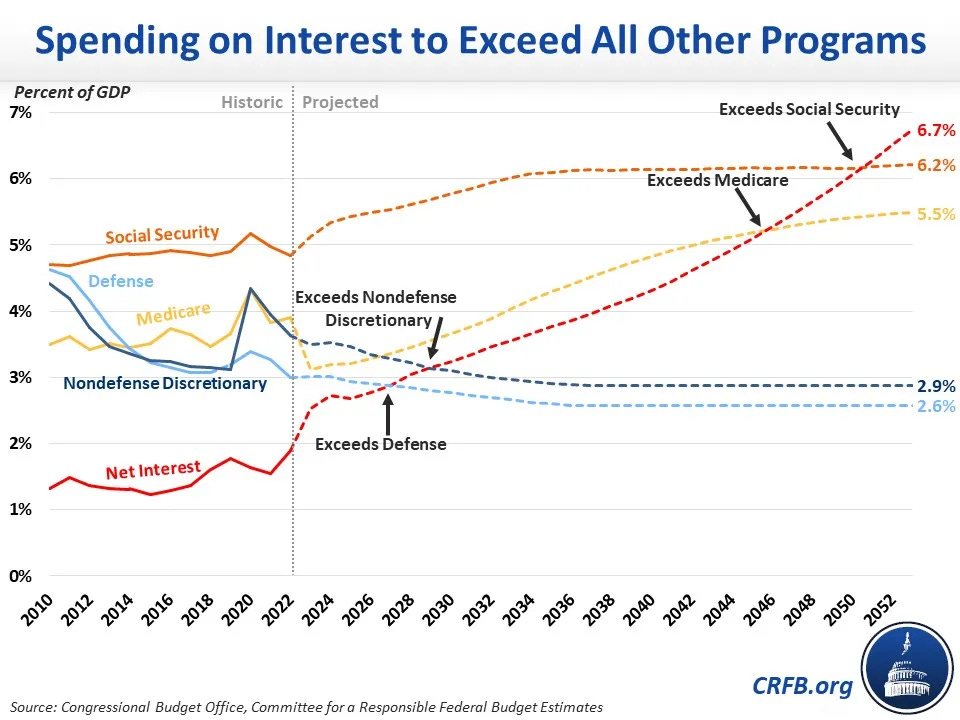

Interest costs are about to skyrocket and something will end up being the victim.

Will it be the stock market? The real estate market? The cryptocurrency market?

This is the kind of time bomb that does not explode immediately, but when it does, it destroys everything.

No market is immune when a “sovereign debt wall” of this magnitude reaches maturity.

This is the story that no one on the fringes of power wants to talk about, the event that will catch most people completely unprepared.

However, for those who understand what is coming, this is the greatest investment opportunity of their lives.

How we got here

To understand the seriousness of the 2026 “debt wall”, we must first understand how we got here.

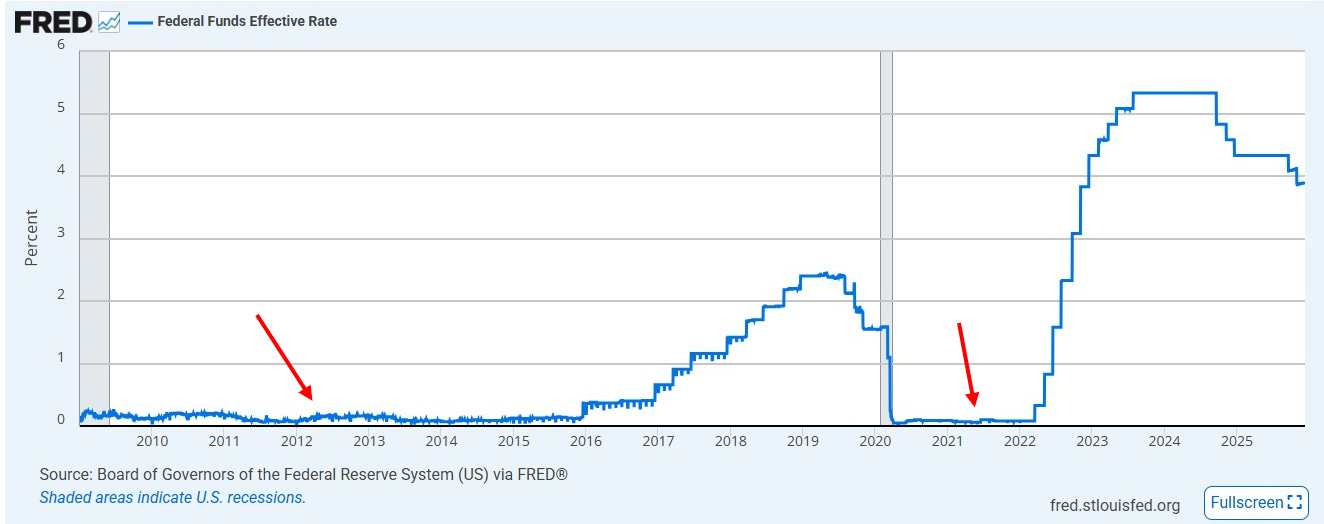

After the global financial crisis of 2008 and again during the COVID-19 pandemic, the Federal Reserve (Fed) and the United States Treasury launched the most radical monetary experiment in human history.

They slashed interest rates to zero and flooded the financial system with trillions of newly printed dollars.

The goal was to stimulate the economy and prevent a deflationary collapse.

But the unintended consequence was the creation of the largest debt “bubble” in history.

With money essentially free, the United States government, corporations and households engaged in an unprecedented credit frenzy.

National debt skyrocketed, from 10 trillion dollars in 2008 to over 38 trillion today.

A large portion of this debt was short term, with maturities of just a few years, in order to take advantage of the exceptionally low interest rates.

It was a massive bet that interest rates would remain low forever.

That bet is about to fail catastrophically.

The party is over.

The collision with reality is only just beginning.

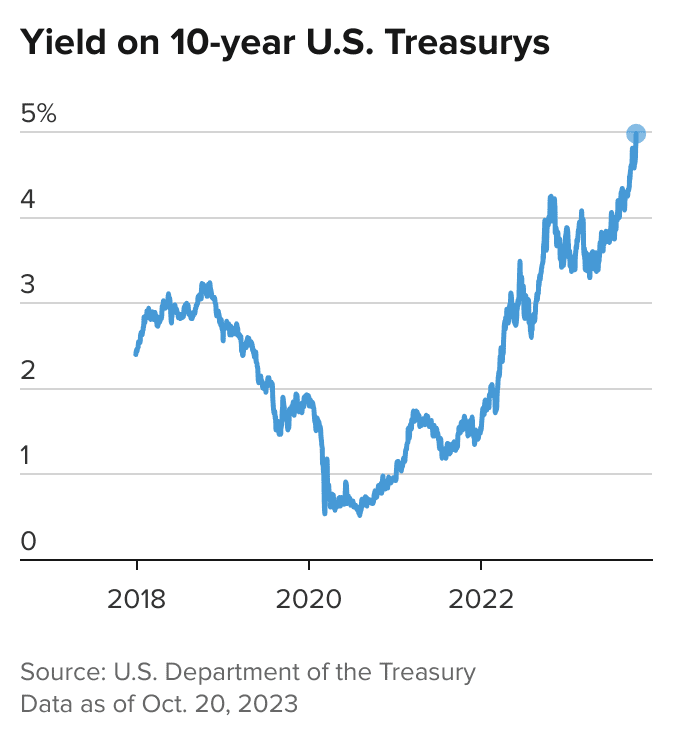

Now, as this mountain of cheap debt begins to mature, it must be rolled over at today’s much higher interest rates.

A 10 year United States Treasury bond issued in 2020 at around 0.5% must now be refinanced at around 4.2% or even 5%.

This corresponds to an increase of approximately 740% in borrowing costs.

And with more than 9 trillion dollars maturing in 2026 alone, the impact on the federal budget will be nothing short of catastrophic.

If the Trump plan fails, the United States will face the greatest economic challenge in its history, and the global economy along with it.

www.bankingnews.gr

Σχόλια αναγνωστών