Google’s parent company, Alphabet, recently proceeded with a debt issuance totaling 32 billion dollars, including 1 billion pounds in one hundred year bonds, the so called century bonds.

These bonds are named as such because they mature in 100 years, in 2126.

Although the century bond represents a small portion of the recent issuance and an even smaller part of the company’s total outstanding debt, 78 billion dollars, this specific tranche secures ultra long term capital.

With this small portion of debt, Alphabet is effectively shielded against future interest rate cycles and refinancing needs at maturity.

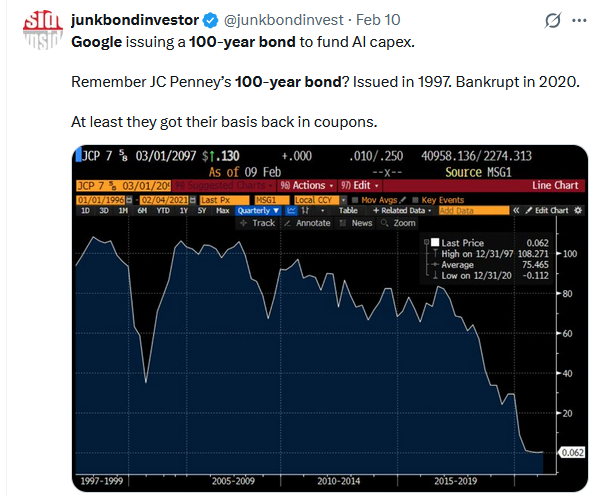

One hundred year bonds are typically issued when companies can borrow at low cost and, most importantly, when investors have confidence in the issuer’s long term viability.

Buyers must believe that the issuer will remain solvent even a century from now.

Investors maintain positive prospects

Strong demand for Alphabet’s century bonds, as reflected in orders several times the offered amount, indicates that long term institutional investors, such as pension funds and insurance companies, maintain positive prospects for Google.

What makes the issuance particularly noteworthy is the rarity of century bonds, especially in the corporate sector.

Ultra long maturities are usually associated with sovereign issuers or institutions such as universities.

Only a handful of major corporations have historically moved forward with such issuances.

Indeed, Alphabet’s deal marks the first century bond issuance by a technology company since Motorola in 1997.

The reason for this rarity is risk.

Over a 100 year horizon, industries transform, business models disappear, and inflation can radically alter real returns.

The big bond issuance “game” for AI expansion

Alphabet became the second major technology company to tap bond markets this year, following Oracle, which issued 25 billion dollars in debt one week earlier.

The cloud services and search giant raised nearly 32 billion dollars in less than 24 hours to finance an unprecedented investment program aimed at expanding artificial intelligence (AI) infrastructure, responding to rapidly growing demand.

On Monday, 9 February, Alphabet raised 20 billion dollars through the largest dollar bond issuance in its history, far exceeding the 15 billion initially expected, after generating one of the largest order books ever recorded.

According to Bloomberg, the offering attracted bids exceeding 100 billion dollars at its peak.

Analysts at Saxo Bank described the demand as “overwhelming”.

It should be noted that the issuance was structured across seven separate tranches.

On Tuesday, 10/2, Alphabet further diversified its funding sources by issuing bonds in pounds sterling and Swiss francs.

Specifically, it raised 5,5 billion pounds, approximately 7,5 billion dollars, through five sterling denominated tranches.

Of particular importance, this issuance included an extremely rare 100 year bond, the first time since the dot-com bubble era that a technology company has issued debt with such an extreme maturity.

The issuance of a 100 year bond is unusual for the technology sector, which typically favors short or medium term corporate debt.

As an analyst from investment platform eToro noted, “the ability of a technology company to issue a 100 year bond shows that investors increasingly view hyperscalers as long term infrastructure rather than cyclical technology businesses”.

In addition, Alphabet raised the equivalent of 4 billion dollars in Swiss francs through five different maturities.

Combined with Monday’s 20 billion dollar issuance, Alphabet raised a total of 31,5 billion dollars within the week, surpassing Oracle’s 25 billion dollar issuance one week earlier.

It is worth noting that Google’s parent last tapped the US bond market in November, raising 17,5 billion dollars in a deal that attracted approximately 90 billion dollars in bids.

As part of that transaction, the company issued a 50 year bond, the longest dated corporate technology bond issued in dollars last year.

At the same time, it raised 6,5 billion euros from the European bond market.

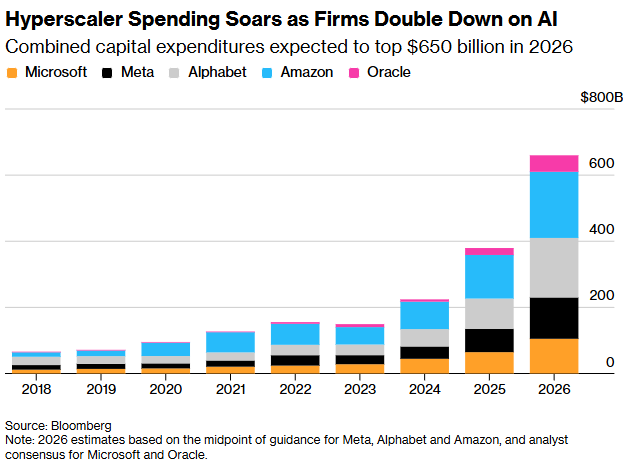

Capital expenditures reach 185 billion dollars in 2026

The issuances occurred less than one week after Alphabet surprised Wall Street, announcing that its capital expenditures (capex) would reach up to 185 billion dollars this year to finance its AI ambitions, an amount exceeding the combined spending of the previous three years.

The company stated that these investments are already boosting revenues, as artificial intelligence increases activity in online search.

Alphabet is among the few technology companies that have embarked on aggressive borrowing to finance massive AI infrastructure investments.

Its long term debt quadrupled in 2025, reaching 46,5 billion dollars.

Chief Financial Officer (CFO) Anat Ashkenazi stated that, when evaluating the overall investment plan, “we want to ensure that we act in a fiscally responsible manner, investing appropriately while maintaining a very healthy financial position for the organization”.

What the bond issuance means for investors

In summary, the bond issuance means that Alphabet is leveraging its strong credit profile, rated AA+ by S&P Global Ratings and Aa2 by Moody’s Investors Service, to borrow at attractive interest rates.

The funds are being used to finance part of its extensive AI infrastructure program, including the construction of data centers and the procurement of advanced processors, such as those from Nvidia (NVDA), in order to maintain its competitive advantage.

Naturally, this entails costs.

The company must pay interest, reducing retained earnings.

Fourth quarter interest expenses reached 298 million dollars, compared with 53 million dollars one year earlier.

Although the amount remains relatively modest, it represents a new factor that investors must monitor.

Alphabet states that it is already observing revenue enhancement driven by these investments, as online search activity increases, and if this trend continues, combined with strong growth in cloud services, the elevated capital expenditures will be fully justified.

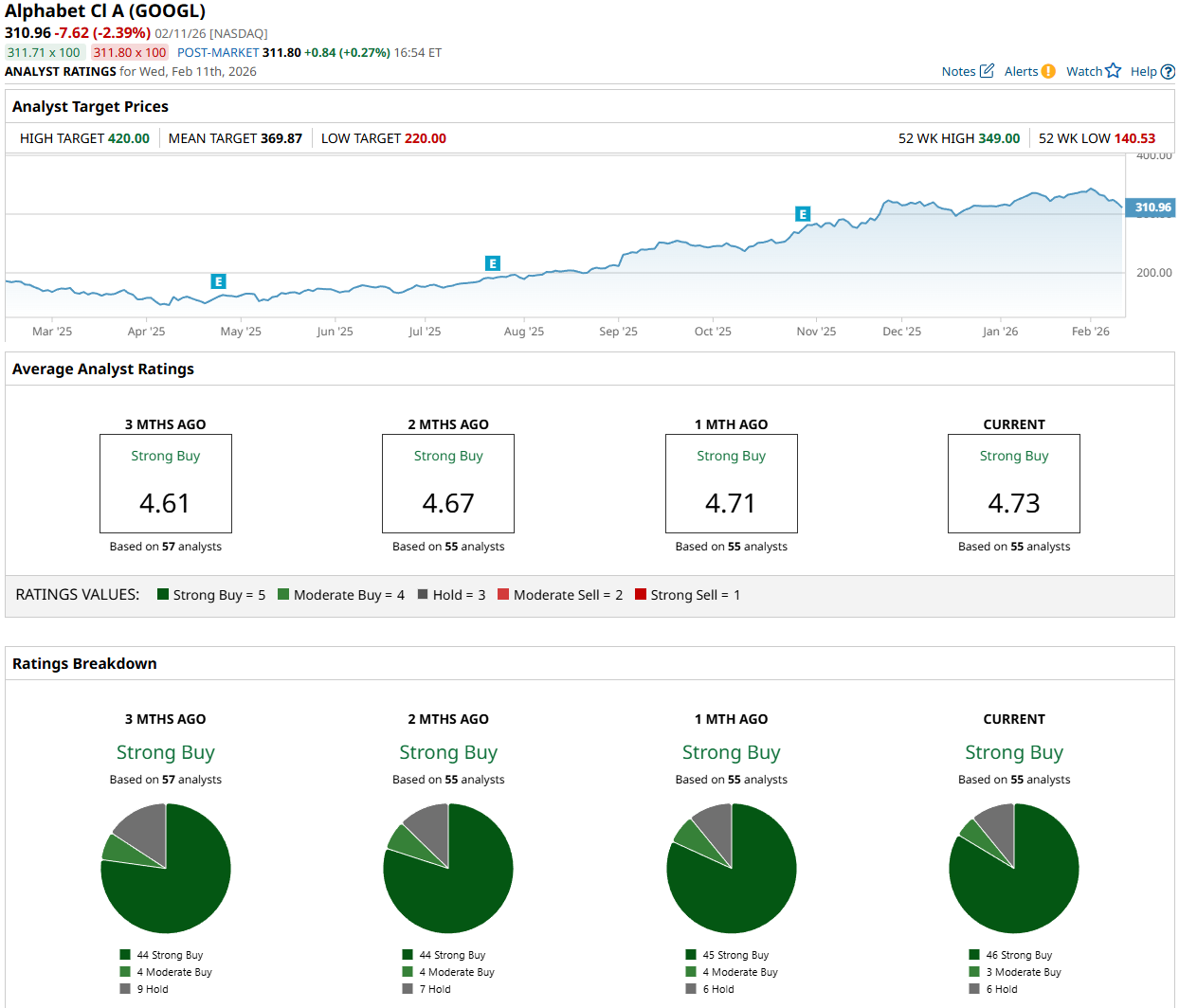

Wall Street analysts remain highly optimistic regarding Alphabet’s stock, assigning it an almost unanimous “Strong Buy” rating.

Out of 55 analysts covering the stock, 46 recommend “Strong Buy”, three “Moderate Buy”, and six “Hold”.

The average price target for GOOGL stands at 369,87 dollars, implying a potential upside of 19% from current levels.

www.bankingnews.gr

Σχόλια αναγνωστών