Goldman Sachs analysis provides a clear picture of the new landscape on the Greek trading floor.

Serious market turbulence is expected to hit the Athens Stock Exchange following Greece's promotion to developed market status by MSCI and FTSE. According to an analysis by the American firm Goldman Sachs, while certain stocks—primarily systemic banks and OPAP—are expected to absorb massive capital inflows and emerge as winners, others will face significant outflows that threaten to "drown" their valuation.

Specifically, MSCI has officially launched the consultation process for Greece's reclassification from Emerging to Developed Market, including its inclusion in the MSCI Europe index. The final result is expected to be announced by the end of March, with the implementation of the index changes scheduled for August 2026.

As Goldman Sachs points out, it is noteworthy that both the consultation period (two months) and the implementation timeline (five months) have been significantly accelerated. This demonstrates the determination of international financial houses to move forward quickly with the upgrade. This move follows FTSE's announcement on October 7, 2025, which also upgrades Greece from Advanced Emerging to Developed Market, with implementation in the September 2026 index in a single tranche.

In this context, Goldman Sachs analysts estimate that net passive outflows will be moderate: approximately $200 million from MSCI and $120 million from FTSE, despite massive capital movements exceeding $7.4 billion and $6.2 billion, respectively. These outflows primarily reflect size reductions and deletions due to stricter developed market criteria, which offset the expected inflows from funds tracking developed market indices.

Simply put: Greece is dynamically entering the global investment spotlight. Large capital flows are expected to shake up stocks, but net losses remain limited—a development that could create significant opportunities for investors.

Winning stocks and the losers

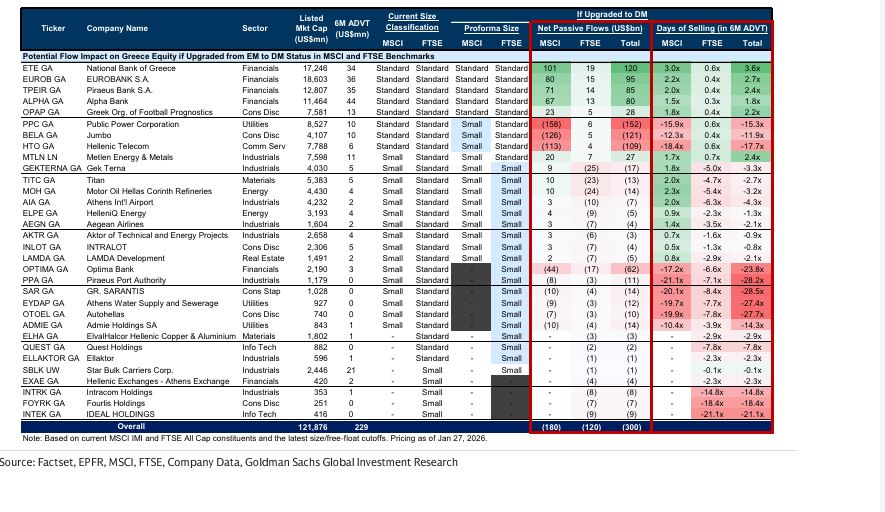

Furthermore, Goldman Sachs presents the likely impact on capital flows for Greek equities in the event that Greece is upgraded from Emerging Markets (EM) to Developed Markets (DM) in the MSCI and FTSE indices. It notes that the total capitalization of the Greek market stands at $121.876 billion, with the average daily trading volume over the last six months reaching $229 million.

Regarding total net passive flows, outflows of approximately $300 million are projected, of which $180 million relates to MSCI funds and $120 million to FTSE funds. These outflows mainly reflect changes in the size category of stocks, which outweigh the inflows from funds focused on developed markets (DM).

In this environment, the biggest beneficiaries will be the systemic banks and OPAP. Specifically, the National Bank of Greece is estimated to receive inflows of $120 million, Eurobank $95 million, Piraeus Bank $85 million, and Alpha Bank $80 million. OPAP is expected to see inflows of $28 million, while Metlen is projected at approximately $27 million.

On the other hand, significant outflows are expected for stocks undergoing reclassification. PPC (DEI) will record outflows of $152 million, Jumbo $121 million, and OTE $109 million. Substantial outflows are also predicted for Optima Bank ($62 million), Titan ($13 million), Motor Oil ($14 million), and GEK TERNA ($17 million).

Categorization

Regarding size categorization, after the upgrade to developed market status, the four systemic banks and OPAP will remain in the Standard Size category, while PPC, Jumbo, and OTE will be downgraded to Small Cap, explaining their large outflows. Other stocks, such as Metlen, Titan, Mytilineos, and HELLENiQ ENERGY, will remain or be classified as Small Caps.

Goldman Sachs also highlights how "heavy" the liquidity hit will be for some stocks based on the days required to absorb the outflows. The most vulnerable cases include PPA (OLP) with 28.2 days, EYDAP with 27.4 days, Autohellas with 27.7 days, Fourlis with 18.4 days, and Ideal Holdings with 21.1 days.

In conclusion, Goldman Sachs estimates that Greece's upgrade to a developed market will primarily benefit banks, while triggering a significant wave of selling in other Greek stock market shares, highlighting the need for careful management and monitoring of market liquidity.

www.bankingnews.gr

Σχόλια αναγνωστών