The debate surrounding stablecoins is intensifying as friction between traditional bankers and crypto market players reaches a boiling point. For some, these digital assets represent an innovation capable of modernizing the financial system; for others, they are a ticking time bomb. A wave of stablecoin adoption appears to be hitting global banks, potentially triggering a domino effect originating in the United States.

The "silent bank run" worrying markets

On January 27, 2026, Standard Chartered released a shocking report: stablecoins—digital currencies pegged to the dollar—could lead to a massive outflow of deposits from US banks. According to Geoff Kendrick, the bank’s head of digital assets research, as much as $500 billion could flee bank accounts by 2028. Kendrick argues that stablecoin adoption is no longer a problem limited to emerging markets, but a structural issue for banks in developed economies.

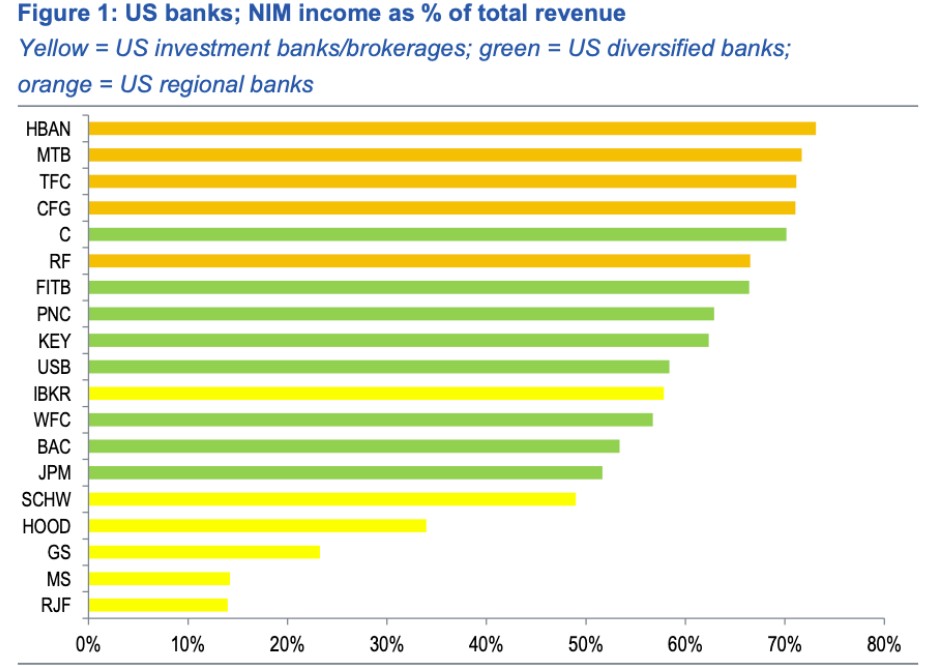

Kendrick identifies the net interest margin (NIM) as the most accurate indicator of stablecoin exposure, given that deposits are the primary driver of NIM. Based on this criterion, US regional banks appear significantly more vulnerable than large, diversified institutions or investment banks, which rely more on fees, trading, and capital market activities. This distinction is critical, as stablecoins increasingly absorb low-yield transactional balances—the exact type of deposits regional banks depend on most.

The problem is exacerbated by the fact that the two largest issuers, Tether and Circle, maintain only a minimal percentage of their reserves in banks: 0.02% for Tether and 14.5% for Circle. In other words, capital is leaving the banking system without returning to it. Kendrick is categorical: stablecoins constitute a systemic risk that many continue to ignore.

Regulatory deadlock and political conflict in the US

At the heart of this silent crisis lies a political confrontation between traditional finance and the crypto industry. The CLARITY Act, a bill aimed at regulating stablecoin issuers, remains stalled in the US Congress. The proposed legislation prohibits the payment of interest on stablecoins, a measure backed by big banks but rejected by companies like Coinbase, which view it as a blow to innovation.

Meanwhile, stablecoins are multiplying without a clear legal framework, serving both as a refuge from crypto volatility and as an alternative to traditional payment systems. Standard Chartered notes that this expansion fuels a permanent erosion of bank deposits, particularly weakening local institutions. Kendrick points out that domestic demand "dries up" local deposits, noting that currently, about two-thirds of demand comes from emerging markets and one-third from developed economies.

The paradox of the "digital dollar"

The paradox is clear: the tokenized dollar strengthens the international reach of the US currency while simultaneously weakening the very banking institutions that support it. At the World Economic Forum in Davos, Circle CEO Jeremy Allaire dismissed these fears as "entirely irrational," arguing that stablecoins transform rather than destroy finance. However, prolonged regulatory inertia may allow the crypto market to de facto shape the future stability of the banking system.

www.bankingnews.gr

Σχόλια αναγνωστών