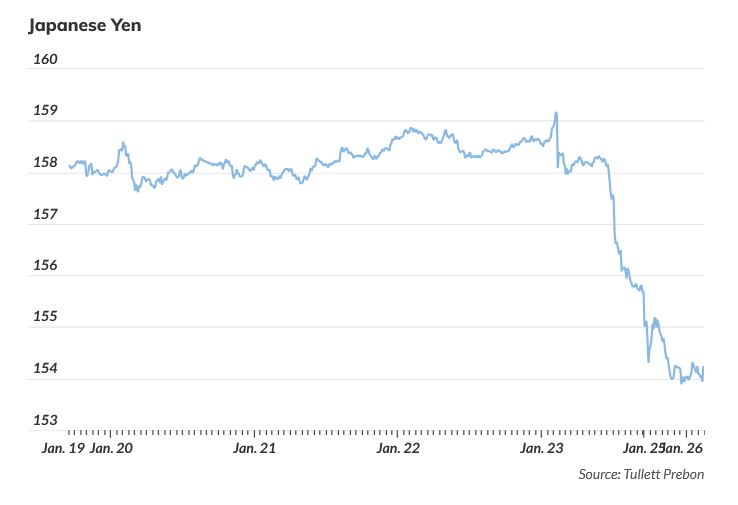

A new, potentially explosive landscape is emerging in the global financial system, with Japan at its epicenter and the long undervalued exchange rate of the yen.

The latest warning comes from Michael Burry, the legendary investor who predicted the subprime crisis and became globally known through the film The Big Short.

As he stated, the Japanese currency is on the verge of a powerful trend reversal, a development that could cause severe shocks to U.S. equities, and not only.

According to Burry, its prolonged weakening has reached a critical point.

Recent moves by Japanese authorities, along with a silent “rate check” that appears to have been carried out by the Federal Reserve Bank of New York, ignited turmoil in foreign exchange markets.

As revealed by the Wall Street Journal, the New York Fed contacted potential counterparties for transactions in the yen dollar pair, following repeated warnings by Japanese officials that the currency’s weakness will no longer be tolerated.

The message from Tokyo is clear. Japan declares itself ready to act and to coordinate with the United States, within the framework of the joint agreement of the finance ministers of the two countries from September.

Chief Cabinet Secretary Minoru Kihara made it clear that the government is closely monitoring developments and does not rule out interventions, confirming that the yen has become a frontline geoeconomic issue.

Michael Burry leaves no room for misinterpretation.

As he stresses, it is already too late for a trend change regarding the Japanese yen, and the consequences of such a move will be multiple.

The greatest risk, according to him, is the massive repatriation of Japanese capital, as investors begin chasing higher returns in the domestic market.

Such a reversal in capital flows could deliver a serious blow to U.S. markets, which in recent years benefited from capital flight from Japan due to ultra low interest rates.

The picture becomes even more worrying when taking into account that yields on Japanese government bonds are steadily rising.

As Burry explains, the combination of higher interest rates in Japan and lower interest rates in the United States could work in reverse compared to previous years, hurting both U.S. equities and bonds.

What Morgan Stanley says

At the same time, alarming signals are also coming from Morgan Stanley.

Michael Wilson, chief equity strategist for the U.S. stock market, revealed to his clients that he recently returned from Japan.

As he noted, the majority of investors he spoke with believe that the yen will move toward levels of 140 to 145 against the dollar.

This assessment is reinforced by analysis from Morgan Stanley’s foreign exchange team, which places the “fair” value of USD/JPY near the 145 area.

Although Wilson maintains a more optimistic stance on U.S. equities, he acknowledges that increased volatility in foreign exchange represents one of the key tactical risks for markets.

A sharp strengthening of the yen could trigger violent capital movements, pressuring valuations on Wall Street at a time when markets remain highly sensitive to external shocks.

The difference between the assessments of the two men is critical.

On one side, Michael Burry sees on the horizon a structural shift in capital flows that could overturn the narrative of U.S. market dominance.

On the other, Michael Wilson is betting on strong earnings growth for the S&P 500 and a recovery in economic activity.

However, even the most optimistic admit that a sudden appreciation of the yen could act as a catalyst for instability.

The Japanese currency, long regarded as “dead weight” for markets, is suddenly transforming into a potential source of systemic risk.

If the yen does indeed rebound sharply, the effects will not be confined to the foreign exchange market, but will spread to equities, bonds, and global capital flows.

And as warned by the man who first saw the great 2008 crisis coming, Michael Burry, Wall Street may once again be underestimating a risk that is building quietly, but could erupt abruptly.

A violent sell off in Japanese government bonds has exposed a massive systemic risk embedded in Japan’s roughly 7 trillion dollar bond market, sending shockwaves across global finance. Long regarded as one of the world’s most stable markets, Japan experienced in a single day what usually unfolds over weeks or months, as yields on long dated bonds surged to historic highs. The 40 year Japanese bond broke above 4% for the first time since its issuance in 2007, while yields across the curve spiked sharply, stunning even veteran bond traders.

The trigger was political. A pledge by Prime Minister Sanae Takaichi’s government to cut food consumption taxes ahead of elections, without specifying funding sources, reignited fears over Japan’s fiscal discipline and ballooning debt. Weak demand at a critical 20 year bond auction amplified the panic, forcing investors to reassess risk premiums in a market long insulated by ultra low rates and central bank support. Calls quickly emerged for emergency intervention by the Bank of Japan to stabilize conditions.

This rupture marks the end of an era. For decades, Japan functioned as a global anchor of cheap funding and stability, similar to the U.S. dollar or the Swiss franc in times of turmoil. That perception has now collapsed. Rising inflation, aggressive fiscal expansion, and growing expectations of interest rate hikes have shattered the old equilibrium, pushing yields higher and undermining confidence in both Japanese bonds and the yen.

The fallout is already spreading beyond Japan. Bond yields in the United States, the United Kingdom, and Germany are rising in tandem, while the U.S. 10 year Treasury, a global pricing benchmark, has climbed above 4.3%. At the same time, the dollar has weakened to a four month low amid speculation of coordinated U.S. Japan action to support the yen, while gold has surged to record highs above 5,100 dollars per ounce as investors seek safety.

With snap elections looming in Japan, authorities now face a brutal dilemma: defend the yen with higher rates and risk a deeper bond market collapse, or keep rates low and risk further currency depreciation. Markets are increasingly volatile, intervention expectations are rising, and investors are bracing for sharp capital flows. What was once seen as a contained, domestic issue is now emerging as a global fault line, with Japan’s bond market threatening to become the next major source of financial contagion.

www.bankingnews.gr

Σχόλια αναγνωστών