The gold reserves of the Russian Federation increased by 216 billion dollars from the beginning of the special military operation in Ukraine, due to the sharp rise in global prices of the precious metal, according to calculations by Bloomberg in a publication citing data from the Central Bank.

According to the agency, this made it possible to restore most of Russia’s lost financial capacity, even without the return of assets blocked by the European Union.

However, how accurate is this assessment.

This is because we are talking about an accounting rather than a physical indicator.

As Bloomberg notes, over the past four years gold has recorded a historic price surge, 65% in 2025, driven by strong demand from central banks, international concerns about inflation and the dollar, and geopolitical turbulence.

The Russian Ministry of Finance expects a further increase in the price of the precious metal to 5000 dollars per ounce, as the level of 4750 dollars per ounce has already been reached.

The increase of 216 billion dollars in the value of gold reserves is comparable to the volume of Central Bank assets frozen in the European Union following the launch of the special military operation in Ukraine, 210 billion euros or 244 billion dollars.

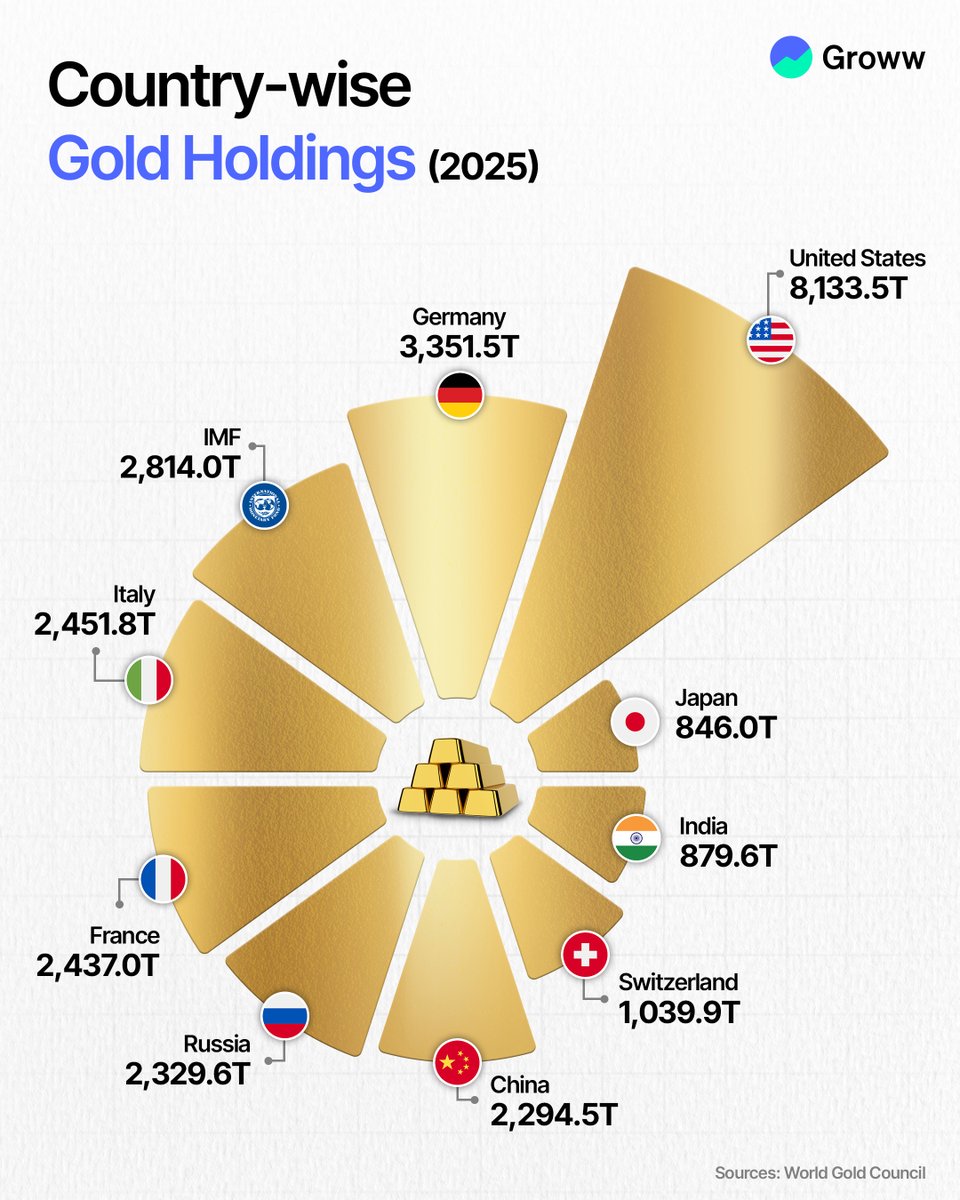

According to the Central Bank, Russia’s international reserves at the end of 2025 amounted to 754.85 billion dollars, of which 326.54 billion dollars corresponded to monetary gold.

For comparison, on February 1, 2022, the country’s gold reserves were estimated at 132.26 billion dollars, when the spot price of the yellow metal stood at 1800 dollars per ounce.

The new role of gold

According to Bloomberg, the securities and cash frozen in Europe cannot be sold or used as collateral, however the Bank of Russia can, if necessary, utilize or liquidate gold.

Russian assets in the EU were frozen because the depository Euroclear suspended transactions with Russia’s National Settlement Depository, which Brussels sanctioned in the summer of 2022.

“In general, the rise in the price of gold allowed Russia to significantly restore its lost financial capacity, but with important caveats,” says Alexander Shneiderman, head of customer support and sales at Alfa Forex.

“Indeed, the revaluation of gold reserves amid the surge in global prices led to a significant increase in their dollar value, exceeding 216 billion dollars.

In this sense, gold confirmed its role as a strategic defensive instrument that does not depend on jurisdictional risks and sanction restrictions.”

At the same time, it is important to understand that this primarily concerns value hedging, the analyst emphasizes.

The increase in reserves is not due to a physical increase in the volume of gold, but to the rise in its market price.

That is, it is largely accounting in nature.

Russia increased gold exports to China by 800%

According to information published by RIA Novosti based on data from Chinese customs, the volume of physical gold deliveries from Russia to China in 2025 surged ninefold, reaching 25.3 tons, corresponding to an increase of 800%.

In value terms, the increase was 14.6 times, reaching 3.29 billion dollars, as calculated from annual results.

Notably, both in tonnage and monetary terms, these figures are unprecedented in the entire history of trade relations between the Russian Federation and China.

In December 2025, Russian gold exports to China amounted to 1.35 billion dollars, corresponding to 10 tons, also marking a historic high.

Over the past year, Russia ranked seventh among countries supplying gold to China by volume.

Switzerland remains the leader, exporting metal worth 25.73 billion dollars to China, followed by Canada at 11.06 billion dollars, South Africa at 9.42 billion, Australia at 8.77 billion, and Kyrgyzstan at 4.95 billion.

It is worth noting that in 2024 Russia ranked eleventh among exporters.

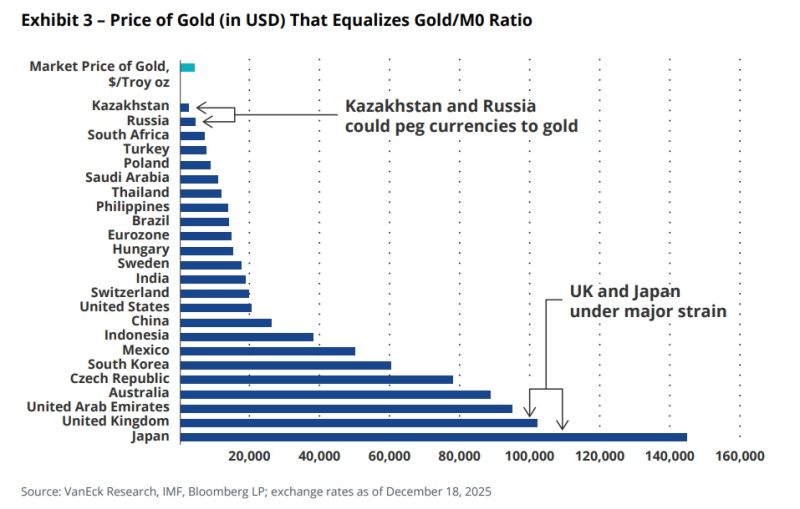

The sharp increase in China’s gold purchases is taking place as part of Beijing’s active strengthening of its own gold reserves and its strategic reduction of dependence on the dollar.

As noted as early as November by the Financial Times, actual gold imports into China for 2025 may significantly exceed officially published figures.

Hidden purchases of up to 250 tons by Beijing

According to Societe Generale, China could purchase up to 250 tons of the precious metal, a volume corresponding to more than one third of total global central bank purchases during the previous year, 2025.

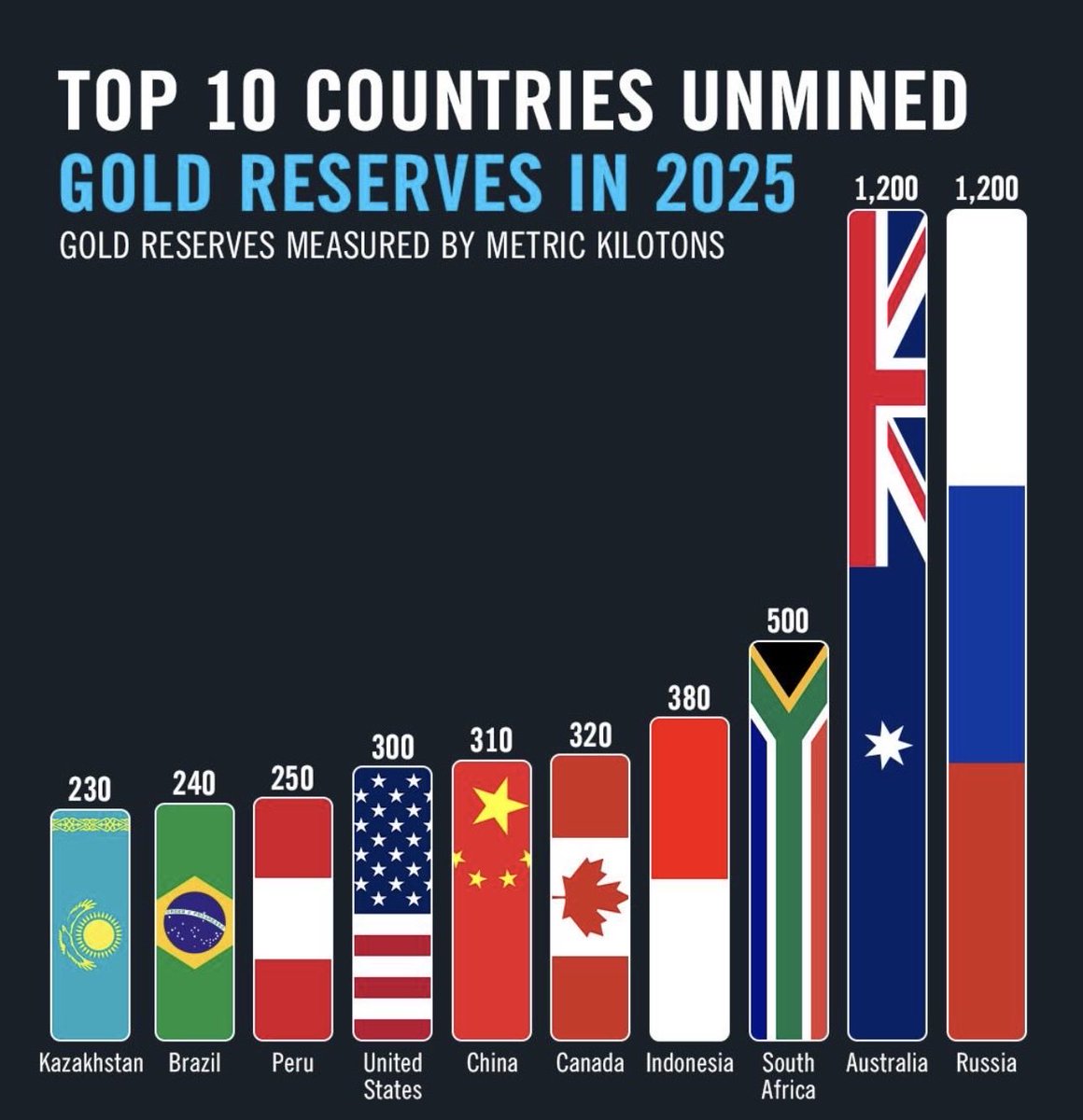

According to the analytical report, in the first half of last year, January to June, gold production in Russia increased by 5.5% compared to the same period of the previous year, reaching 160 tons.

Experts predicted that by the end of the year production would reach 345 tons, which would mean a 45% year on year increase, with production in 2024 at approximately 330 tons.

Linking currencies to gold

After the start of the Ukrainian conflict and the tightening of the sanctions regime, the total volume of Russian gold exports decreased by 40%, from 261 tons in 2022 to 158 tons in 2024.

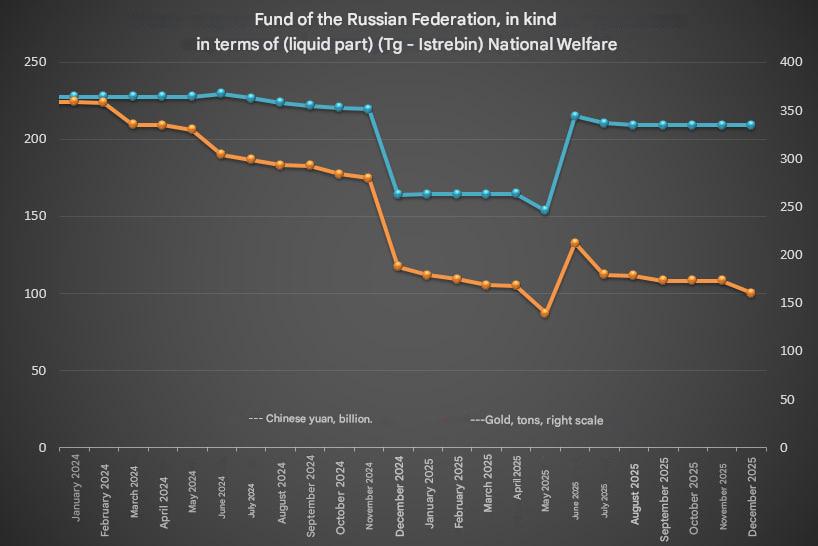

According to data from the Russian Ministry of Finance for the period from 2022 to 2025, the volume of gold held in the National Wealth Fund, which is used to cover the budget deficit, decreased by 71%.

At the beginning of 2025, there were 160.2 tons of the precious metal in unallocated metal accounts at the Central Bank within the National Wealth Fund, whereas in May 2022 the corresponding figure amounted to 554.9 tons.

www.bankingnews.gr

Σχόλια αναγνωστών