Germany's fiscal delusion: Bond markets will "punish" Merz's borrowing spiral.

For years, Germany was considered the ultimate bastion of fiscal stability within the Eurozone. Today, however, the volatile and aggressive fiscal policy of the Merz government is causing increasing tension in the bond markets. Risk premiums for traditional peripheral countries—such as Italy, Portugal, and Spain—against German Bunds are shrinking. For months, something remarkable has been happening in European debt markets. The yield spreads of ten-year government bonds in countries like Italy, Portugal, and Spain relative to Germany, the Eurozone's economic "anchor," are steadily decreasing. Spanish bond yields are now only about 0.4 percentage points above German Bunds, while Italian bonds—from a country with a debt-to-GDP ratio of about 125%—are trading with a spread of just 0.7 points. Capital is visibly moving out of Germany toward other segments of the European bond market. What are the markets pricing in? Perhaps a fiscal derailment of Germany?

Revaluation of German policy

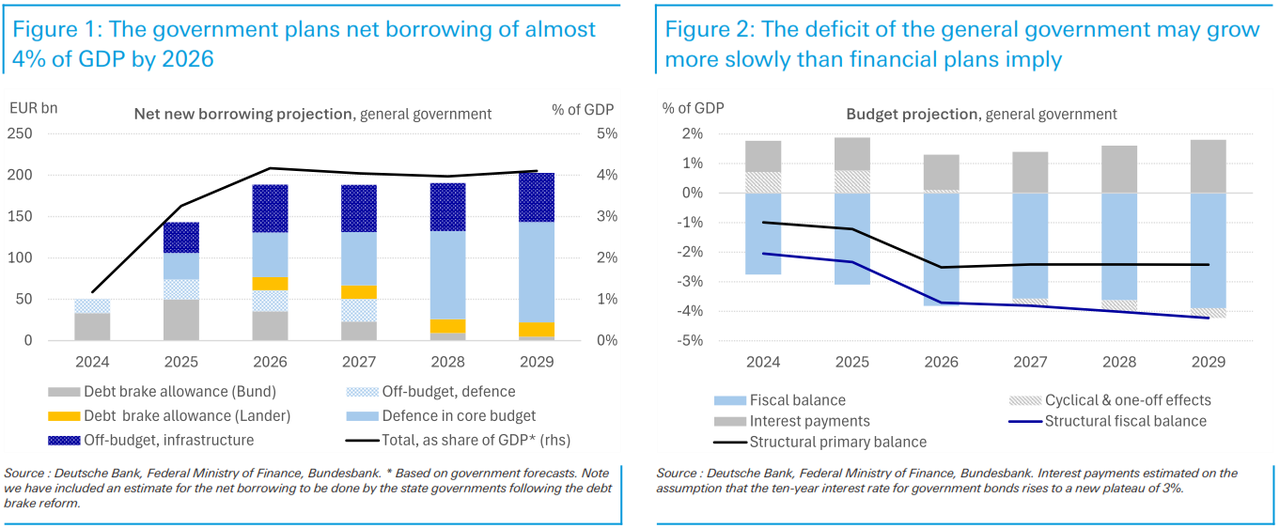

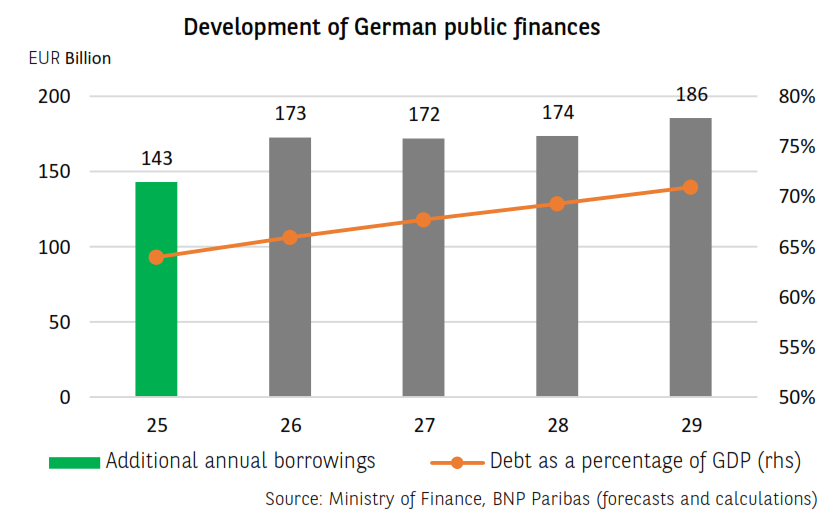

Germany's debt strategy is now being openly reassessed by the markets. By creating the so-called "special fund," Berlin has effectively thrown the country into a borrowing spiral almost overnight. Over the next decade, the issuance of over €850 billion in new debt is projected—on top of a core budget that already shows a deficit of 2.5%–3%. By the end of the decade, German public debt is estimated to approach 85%–90% of GDP. Nothing indicates that an "economic miracle" will halt this course. Miracles happen in fairy tales and children's books—and not even the children's book author and former Economy Minister Robert Habeck managed such a feat. Indirect liabilities from pension and social systems are not even taken into account—neither in Germany nor elsewhere. In the bond markets, however, the absolute level of debt does not matter as much as its relative change. And this is exactly what is being priced: the sharp increase in German borrowing. The problem is exacerbated by the fact that the debt increase is not accompanied by substantial value creation. German policy channels state credit—which later translates into higher taxes and inflation—into an economic vacuum, much like centrally planned systems did.

Markets are "looking ahead"

Investors are watching German policy with strict skepticism: the exit from nuclear power, skyrocketing energy prices crushing industry, and a migration policy draining the social state—all of these are incorporated into the pricing of Bunds. The bond markets are always a bet on the future, a vote of confidence or distrust in the stability of a state. The result is clear: yields are rising—and will continue to rise. As debt swells, its servicing becomes more expensive. This is the relentless logic of the markets. The data cannot be "rebranded" otherwise by Kanzleramt communicators or friendly party media. German productivity has been frozen since 2018 and is now declining. Industrial production has collapsed by approximately 20%. Hundreds of thousands of manufacturing jobs have been lost, while only the public sector expands, with the state now absorbing over 50% of economic activity. Germany is heading toward a "war logic" economy that yields almost zero benefits to real production. Alongside an already failed "green economy," a parasitic sector is developing that consumes resources, creates artificial employment, and fuels a web of companies absorbing state money. The cost is covered by ever-increasing burdens hitting productive workers.

Ideology over economy

This downward trajectory is being consciously and ideologically accelerated by the government of Chancellor Friedrich Merz. The crisis is treated as a "solution": a means to enforce a climate socialist agenda and maintain political power, even as social pressure grows. What seems to escape the planners of "climate socialist" policy, such as Merz, is that every economic activity and every prospect of prosperity relies on cheap and reliable energy. Germany's current crisis—productivity collapse and deindustrialization—speaks for itself. It was not inevitable; it is recorded in economic history as a unique act of self-inflicted destruction. The efforts of the Merz government and its like-minded associates to manage the crisis through communication tricks, intensifying censorship, and the constant targeting of entrepreneurship show one thing: they do not realize this is a road of no return. Climate socialism is the problem, not the solution—and the markets along with Germany's real economy prove it.

The message from the markets

Certain shifts are already visible. Italy, for example, has begun moving gold reserves from the central bank to state vaults and is pursuing energy autonomy via natural gas from North Africa. The markets are rewarding this: yields and risk premiums are falling. Investors seem to see Italy as a "first survivor" in a potential major Eurozone crisis. Germany lacks a corresponding narrative. The image is further burdened by Berlin's almost inexplicable commitment to the war in Ukraine without a clear democratic mandate, accelerating fiscal decay. Merz plans to channel approximately €11.5 billion from the 2026 budget directly to Kyiv—a stance shared by Paris, London, and Brussels—ignoring even the possibility of a full US withdrawal from the European front. This geopolitical blindness is reflected in the bond markets. The German leadership is playing Vabanque—without historical memory, without a sense of responsibility, without perspective. When the markets will finally downgrade a core pillar of the Eurozone—likely France first—and trigger the collapse of the debt edifice cannot be predicted. As Ernest Hemingway wrote in The Sun Also Rises: "How did you go bankrupt?" "Two ways," Mike said. "Gradually—and then suddenly."

www.bankingnews.gr

Σχόλια αναγνωστών