The European Union is preparing to raise up to 150 billion euros to finance military spending, as the region faces changing security conditions, and in particular the impending relative withdrawal of security guarantees by the United States and the widespread Russia phobia of European elites.

The President of the European Commission, Ursula von der Leyen, announced on Tuesday (30/12) plans for bond auctions which, if approved by the EU member states, will provide funding to national governments for defense expenditures.

The member states will then repay to the Commission the funds they have used, meaning that these amounts will burden the obligations of the nation state.

It has also not been clarified what will happen with objectors.

ECB interventions kept borrowing costs in the Eurozone low

Rise in yields

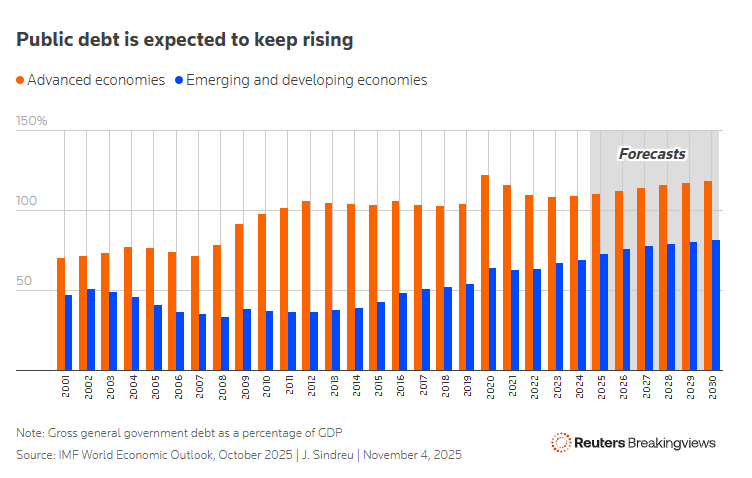

On Friday 2 January, Eurozone government bond yields recorded an increase, as investors prepared for a new year expected to be characterized by extensive debt issuance, the effects of the sharp rise in fiscal spending in Germany, and increased geopolitical turbulence.

Trading sentiment remained subdued after the Thursday (1 January) holiday, however yields on 10 year bonds increased by 2–3 basis points across the region.

In Germany, the Bund yield rose by 3.1 basis points, reaching 2.89%, marking the largest annual increase since 2022, when the global surge in inflationary pressures occurred.

While yields in France also moved higher, Italian yields showed minimal change, while yields on British gilts, which in the past have exhibited strong volatility, declined.

Attention is turning to the forthcoming issuance of a 10 year bond by Slovenia, with underwriting banks such as Barclays, DZ Bank, and HSBC playing a key role.

Commerzbank forecasts that pressures on borrowing costs will remain intense due to new bond issuances, estimating that private investors will need to absorb a record net supply of 234 billion euros over the year.

At the same time, the issuance of a 20 year German bond remains attractive, due to reforms in the Dutch pension system which has significant exposure to German debt.

What the market fears

Ulrika Torell, senior portfolio manager at the Swedish pension fund Alecta, which manages assets of approximately 118 billion euros, stated that the fund would consider investing in new EU debt, based on its previous purchases.

Tony Persson, head of fixed income investments at Alecta, underscored the strong market interest in these bonds, provided that political consensus is achieved, something difficult given the internal political alignments within the EU.

The favorable credit rating (AAA) of the EU enhances the attractiveness of its borrowing, with major rating agencies, except Standard & Poor’s, assigning it a AAA rating, effectively classifying it as an issuer without investment risk.

Germany remains the only major EU economy with a comparable credit rating.

Reduced availability of highly rated bonds, following downgrades of various issuers, has increased interest in Eurobonds, according to Elizabeth Palandeng, representative of APG, the investment arm of the largest Dutch pension fund, ABP.

The gradual (destructive) path toward joint debt

Historically, the EU has proceeded with joint borrowing, however the COVID-19 pandemic constituted a turning point, allowing the Union to raise funds at a time when several member states were facing unsustainable levels of debt.

By the end of 2024, the European Commission had raised 330 billion euros for the Recovery and Resilience Facility (NextGenerationEU) and an additional 100 billion euros through the SURE program to protect employment during the pandemic.

Before this financing mechanism, the Commission issued debt of approximately 500 million euros annually.

In recent years, the EU turned to the markets for 50 billion euros to support Ukraine, as well as an additional 4 billion euros for investments in the Western Balkans.

According to a previous Commission plan, there was an intention to raise approximately 160 billion euros in 2025, which would make it the fifth largest issuer of tradable euro denominated debt this year, although it would still lag behind national treasuries of countries such as France and Italy, which are expected to issue over 300 billion euros.

Fiscal discipline remains an open political issue, particularly among economically strong countries such as Germany and Denmark, which traditionally support limits on the volume and scope of EU joint borrowing.

The impact of joint borrowing on member states

If a significant round of joint borrowing is successful, it could entrench the EU’s position as a regular participant in the bond market.

Von der Leyen’s proposal aligns with the recommendations of former ECB President Mario Draghi for financing joint European challenges through collective resources, recognizing “security and defense” as a core public good.

Alvise Lennkh-Yunus, head of sovereign and public debt at Scope Ratings, emphasized that new joint borrowing would send a positive signal to markets, similar to that created by the NextGenerationEU recovery framework during the pandemic.

At present, the EU faces difficulties in achieving optimal pricing of its bonds, as its securities are not yet included in major sovereign debt indices, an inclusion that would oblige investment funds managing trillions of euros to allocate resources to EU debt.

In addition, the lack of hedging instruments through futures and options differentiates EU bonds from national government bonds such as German Bunds and French OATs.

Stéphanie Riso, senior budget official of the Commission, has expressed the goal of “normalizing” joint European bonds as established financial products, recalling that in the past EU borrowing was treated as debt of organizations with state guarantees.

Riso acknowledged that efforts are being made to clarify to markets the evolving nature of EU bonds.

Despite the fact that the debt market is already competitive and under pressure from the global rise in sovereign borrowing, which has reached the staggering amount of 100 trillion dollars, observers note that joint debt may serve some countries better compared to national issuance, although the increase in bond supply may lead to higher borrowing costs and trigger a debt crisis that would hit the most vulnerable countries, such as France and Italy (we are not even discussing Greece...).

www.bankingnews.gr

Σχόλια αναγνωστών