Americans enter the new year with their debts at historic highs. It is no coincidence that the Federal Reserve (Fed) sent a message regarding stricter conditions for interest rate cuts in 2026 during its December meeting, a move that may deprive millions of debt-reliant Americans of much-needed relief.

Household debt skyrocketed to a record $18.6 trillion during the third quarter of 2025, and it is expected that the Central Bank will reduce its benchmark interest rate only once or twice next year in an attempt to ease borrowing costs.

However, this slow and steady approach means that 2026 will not be the year of relief many borrowers expect. On the contrary, a stagnation in the labor market and sky-high housing prices are expected to keep first-time buyers out of the market. But even if the Fed moves slowly to significantly help borrowers, experts say that those with credit card debt or high-interest auto loans can take action in the new year by trying to improve their credit scores and refinance their loans.

"Regardless of what happens this year, I think it's always important for people to remember they have more power over these issues than they think," said Matt Schulz, a consumer finance analyst at LendingTree. "Whether it’s balance transfer cards, debt consolidation loans, visiting a credit counselor, or calling your credit card issuer to ask for a lower rate."

Household debt at the highest level in history

Americans will enter the new year relying more than ever on debt. Of the trillions of dollars in household debt recorded last quarter, the majority — $13.07 trillion — concerned mortgage balances, according to the New York Federal Reserve's report on household debt and credit policy. Non-housing balances increased by 1% from the second to the third quarter, with credit card and auto loan balances reaching $1.23 trillion and $1.66 trillion, respectively.

With new car prices remaining much higher than most Americans can pay in cash, an increase in auto loan delinquencies is expected for a fifth consecutive year in 2026, according to TransUnion's consumer credit forecast for 2026, although the increases are expected to be smaller over time. The report estimates that credit card delinquencies will remain relatively stable, while mortgage delinquencies will rise due to a mild increase in unemployment.

Risks and high costs

Analyzing these numbers in isolation can be misleading. The widening of the "K-gap" in the credit market means that the financial pressure on lower-income households is hidden behind the growing wealth of wealthier borrowers, who have benefited from the stock market boom and rising home values.

Because low and middle-income households have been particularly sensitive to inflation in recent years, lenders have tightened their lending criteria, according to Warren Kornfeld, senior vice president of financial institutions at Moody’s Ratings. As he stated, the labor market in the new year will be the main factor determining how difficult it will be to get loans approved.

"If the labor market continues its course without a 'significant increase' in layoffs, lenders will likely maintain their criteria as they are," said Kornfeld. "But if the macroeconomic situation deteriorates, then yes, lenders are expected to tighten criteria further."

If interest rate cuts occur in 2026

A significant reduction in the federal funds rate seems less certain for the new year, but it is not entirely unlikely. Fed Chairman Jerome Powell's term ends in May, and Fed Governor Christopher Waller, who is on presidential candidate Donald Trump's list to take over as the next Fed chair, stated that there is room for rate cuts of 50 to 100 basis miles.

If rate cuts take place, "consumers must be ready to take advantage of them," said Michele Raneri, vice president and head of US research and consulting at TransUnion. "You may see that there are good prices, but if you don't have a good enough credit score to get in the door, then you won't get it."

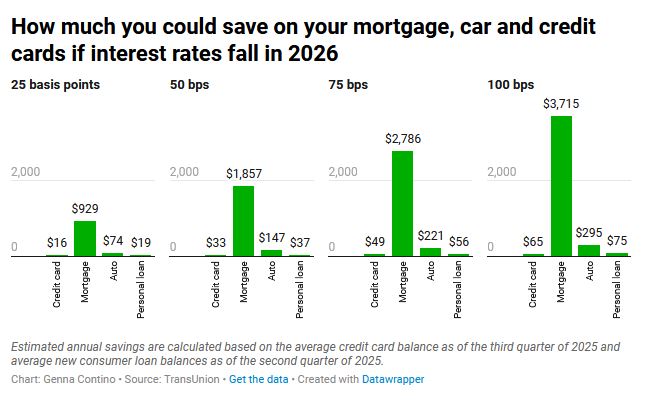

How much borrowers can save

Mortgages

Mortgages are the loans where borrowers could see the greatest interest savings if rates drop in the new year. For the average new loan of approximately $370,000 at a 6.3% rate, a 25-basis-point reduction would save borrowers $929 in interest within a year, according to TransUnion calculations. A 1 percentage point reduction (100 basis points) would mean savings of $3,715.

Mortgage rates decreased in 2025 but remain significantly higher than in 2021, when rates had fallen below 3%. It is important to note that mortgage rates do not directly follow the movement of the Fed's benchmark rate but move in parallel with the yield of the 10-year Treasury note.

Auto loans

A 25-basis-point reduction for a $30,000 auto loan with a 7.64% interest rate would save drivers only $74 a year, while a 100-basis-point reduction would reduce annual interest by $295, according to TransUnion data.

Credit cards

Credit card interest rates are directly affected by the federal funds rate, more so than mortgages and auto loans. But even if the Fed reduced rates by a full percentage point, a credit card holder with the average balance — which was about $6,500 in the third quarter of this year — and a 22.83% interest rate would save only $65 in interest per year.

www.bankingnews.gr

Σχόλια αναγνωστών