France is facing a “serious fiscal problem.”

This well-known reality was acknowledged on Saturday, October 25, 2025, by the Governor of the Banque de France, François Villeroy de Galhau, in an interview with the newspaper La Croix.

Although the Moody’s rating agency maintained the country’s credit rating the previous day, it is now accompanied by a “negative outlook” (instead of the previously “stable” one), something that seems aligned with the Governor’s concerns.

The senior official emphasized that “all rating agencies are worried about political instability” in France.

In his view, the country is not “threatened by bankruptcy, but by gradual asphyxiation,” mainly due to the increasing burden of interest on public debt.

“Our country retains advantages.”

Moody’s explained that it wanted to reflect “the increasing risks of institutional and governance weakening in France, as well as the partial rollback of structural reforms.”

It also pointed to the risk of “permanent political fragmentation,” which could “undermine the functioning of institutions,” with governments “continuing to struggle to secure a parliamentary majority.”

The Banque de France Governor also warned of the risk of “contagion,” meaning an increase in borrowing costs for households — especially in mortgage loans — and for businesses in France, as well as the negative consequences throughout the Eurozone.

The maintenance by Moody’s of the Aa3 rating (good-quality debt) “means that our country retains advantages,” he stressed, expressing hope that growth will reach at least 0.7% this year.

In favor of the “Zucman Tax”

Asked about the so-called Zucman Tax, currently being discussed in Parliament in the context of examining the 2026 budget, Villeroy de Galhau expressed support for the idea that “those who have the most” should pay “their fair share of taxes.”

“Today, it is not fair that the wealthiest reduce their taxes through mechanisms such as holdings patrimoniales (holding companies) or various tax ‘loopholes.’

This must change,” he stated, warning, however, of the risk that a “massive tax” could bring for “entrepreneurs and those who create jobs and innovate.”

In mid-September, François Villeroy de Galhau had already expressed support for “measures against tax avoidance for large fortunes,” so that fiscal consolidation would be “perceived as fair.”

Ten days earlier, he had called on political parties in France to demonstrate “compromise,” saying he was tired of “political waste.” Private debt at 300%

Private debt at 300%

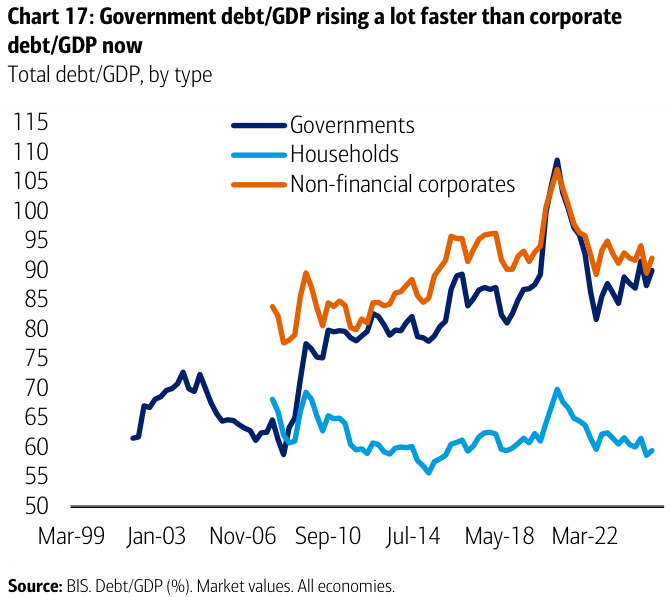

However, France is facing an economic bomb much larger than it appears: private debt approaching 300% of GDP, a level no other country can reach.

Over the last decade, France has accumulated a mountain of corporate obligations like few other economies on the planet.

According to a recent IMF report, the private sector as a whole has accumulated debt exceeding 276% of GDP, compared to 235% a decade ago, when it was already considered high due to the negative effects of the financial crisis.

For comparison: private debt in the United States is at 216% of GDP.

“This is a combination of high household debt... but mainly of non-financial corporate debt,” it is noted.

“French companies are accumulating obligations worth 200% of national GDP, compared, for example, to 152% in the United States, 75% in the United Kingdom, or 152% in Japan.

Although to a lesser extent, households also bear a significant burden. In fact, France is the country where household debt represents the largest percentage of GDP at 71.8%.

In the United States, where household borrowing is a deeply rooted practice, it stands at only 67.5%.”

Self-reinforcing deficits and worsening fiscal position

At the same time, the public deficit is soaring, approaching 6% of GDP, and public debt amounts to 115.6% of GDP, according to European Commission estimates — and the trend is expected to continue rising.

“By adding public and private debt to GDP, the IMF and the Bank of France foresee a major explosion,” it is emphasized.

The total public and private debt of France amounts to 389% of GDP, over 100 percentage points higher than Spain and Italy, and 150 percentage points higher than Germany.

It is still far from Japan’s 456%, but closer than any other.

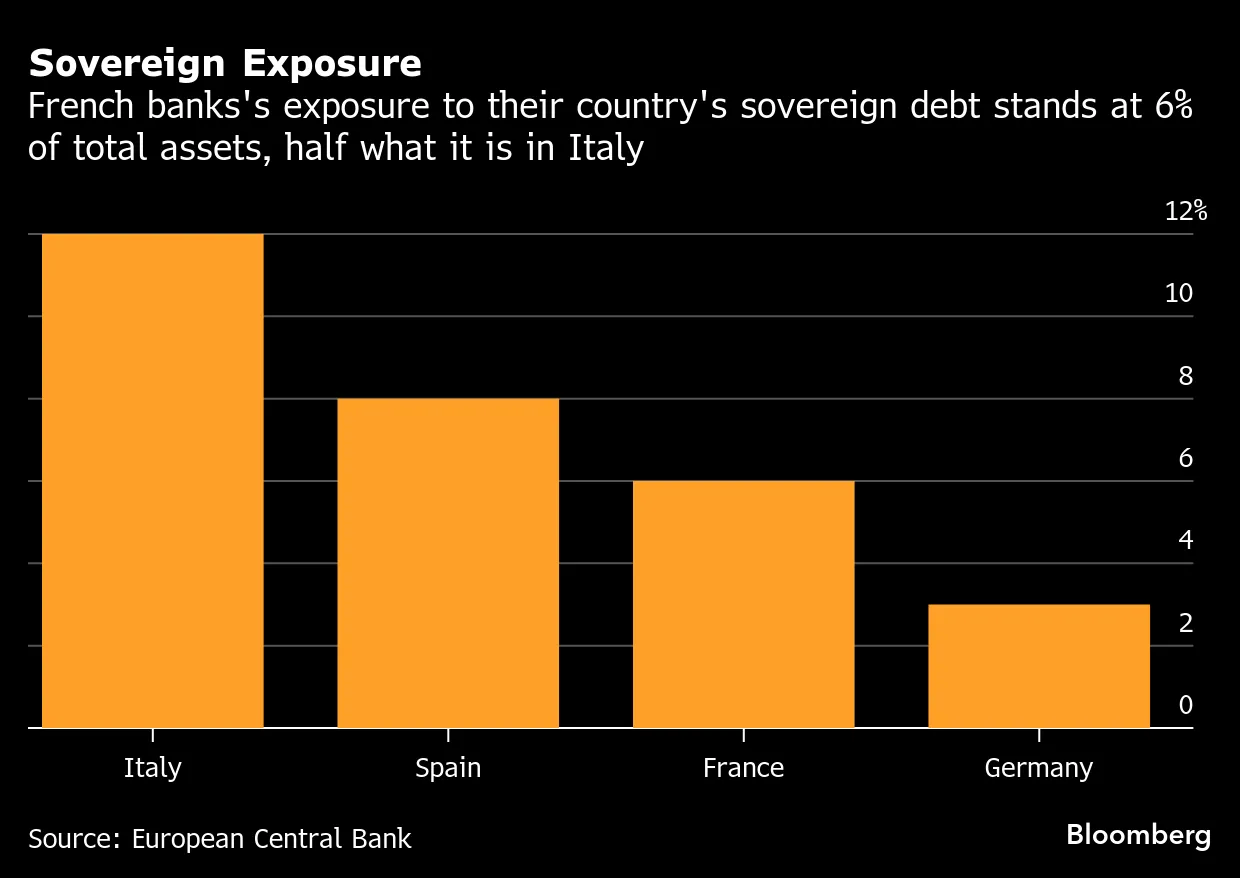

Risk to the stability of the banking system

The IMF has also long expressed concern about the rise in French private debt and warned that this could lead to a banking crisis if it continues to increase — which is happening now.

“The direct exposure of the banking system to companies could create significant secondary effects in case of stress.

The indirect market risk would end up being significant for banks, insurance companies, and funds.”

The risk of contagion in Europe

“Investors have no doubt where the next big bomb to explode in Europe lies.

France is experiencing a self-destructive cycle of deficits and political chaos that seems unstoppable,” they add.

“The restrictive monetary policy of the ECB will not save France in the event of economic shocks,” says Natacha Valla, Dean of the School of Management and Innovation at Sciences Po University.

“As France’s budget is being discussed amid absolute political uncertainty, let us recall the obvious: the framework has changed radically compared to the still recent period when we thought we had fiscal room for maneuver.

First, global debt has changed in scale, with more than 100 trillion dollars in bonds worldwide.

This is unprecedented in scope... and likely structural in nature.

And the worst part is that this debt has not always been used for productive investments.

It has been partly recycled through stock buybacks and refinancing.”

Perfect storm

The Bank of France explains that total debt represents a clear risk, creating a perfect storm in France’s credit crisis.

This enormous burden is beginning to drown the country’s businesses and strangle the economy, preventing the Élysée Palace from generating revenue and curbing the growing deficit.

“This situation exposes it to a series of risks.

The return on equity is beginning to be driven more by leverage than by improvements in operational profitability,” warns the Bank of France.

Also, “their ability to service their debt will deteriorate significantly if interest rates rise in the medium term. It would be harder for them to rebuild their cash reserves.”

The trend shows no signs of recovery.

The cost of debt for French companies continues to rise, following the path of sovereign bonds.

Ultimately, France is the new front from which a “Euro crisis” could emerge.

www.bankingnews.gr

Σχόλια αναγνωστών