The eurozone is facing significant turbulence in financial markets as banks unexpectedly tighten corporate lending, sparking concerns over investment activity and economic growth. The European Central Bank (ECB) is monitoring the situation closely, warning of the risk of sharp market disruptions, while businesses increase their demand for working capital and inventories to partially offset the tightening credit market.

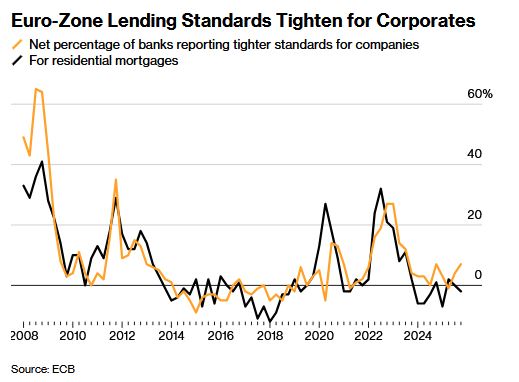

In further detail, as reported by the ECB in its Bank Lending Survey for the fourth quarter of 2025, eurozone banks unexpectedly toughened their criteria for corporate loans at the end of the year. This move casts doubt on investments and overall economic activity just before the ECB determines interest rates this week. "Concerns about the outlook for businesses and the broader economy, as well as reduced risk tolerance among banks, contributed" to this shift, the ECB noted.

According to the report, when asked about the impact of changes in trade policies and related uncertainty, nearly half of the banks assessed their exposure as "significant." They anticipate a further slight deterioration in lending standards for firms during the first quarter of 2026.

ECB on high alert

Lending trends help the ECB assess how effectively monetary policy is being transmitted to the economy. Although officials concluded in December that the pass-through of interest rate cuts remains smooth, they called for close monitoring amid fears of a sudden correction in financial markets.

A discussion published last week by four ECB economists found that the recent recovery in credit activity is more gradual than in previous periods, emphasizing the key role that bank loans play in supporting real economy activity. The region has so far shown resilience against adverse factors such as tariffs, with growth reaching 0.3% in the fourth quarter. This figure exceeded forecasts and strengthens the argument for keeping borrowing costs unchanged again on Thursday. However, the volatility in the trade policies of Donald Trump remains a persistent risk.

Sluggish demand from businesses

Tuesday’s report also showed a further slight increase in demand for corporate credit. "Demand from firms for loans was driven primarily by a rise in demand for inventories, working capital, and other financing needs, while fixed capital investment continued to have an overall neutral net contribution," it stated. In the housing sector, the ECB recorded another increase in credit demand and a slight easing of lending standards.

The rising euro: the newest risk

The surge of the euro is expected to take center stage at the European Central Bank's first monetary policy meeting of the year. According to Bloomberg, eurozone inflation is at risk of being pushed even further below target due to the strengthening of the common currency, raising uncomfortable questions for officials meeting in Frankfurt.

Although the ECB has not changed rates since June and no move is expected on Thursday, there is no shortage of topics for discussion. Since policymakers last set rates on December 18, there have been attacks on the US Federal Reserve, new tariff threats from the US, and, most recently, a striking drop in the dollar. The weakness of the American currency—fueled by comments from US President Donald Trump that it does not worry him—temporarily pushed the euro above $1.20, its highest level since 2021. Eurozone inflation had already dipped slightly below the 2% threshold in December, and a further slowdown is expected. Economists predict the index will stand at 1.7% for January when data is published on Wednesday (4/2/2026).

www.bankingnews.gr

Readers’ Comments