Those who believe in the market economy swear by its spontaneous order, in the sense that the choices of individuals, and only those choices, shape economic priorities through the price mechanism.

The economic media have now been flooded with warnings about the technological “bubble”, and the valuations of big tech companies have soared to the heavens, many times above the real fundamental figures of the companies.

Investments in the sector have absorbed almost all economic activity, and stock performance is tied to the choices of the White House: from public participation in Intel to the deal by President Donald Trump for the sale of NVIDIA processors to China, with a percentage of the profits flowing into public coffers.

The technology sector has been quietly nationalized and is creating an iron grip on the entire economy.

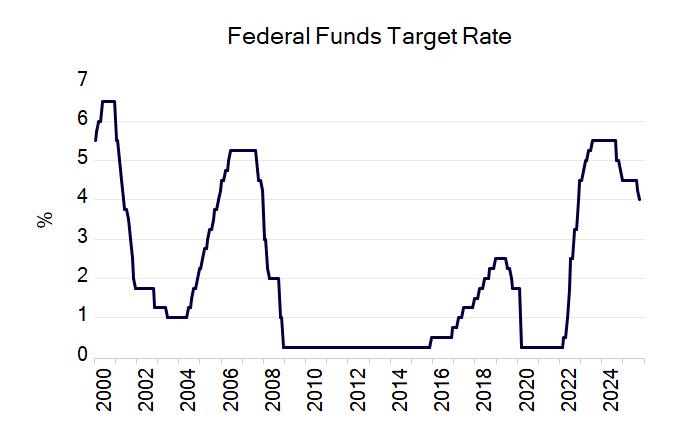

Many rightly associate the creation of “bubbles” with the expansionary monetary policy of the central bank.

This type of policy gives rise to various projects which, in the absence of expansionary monetary policy, would never have appeared.

An expansionary monetary policy, through the reduction of interest rates via increases in the money supply, diverts savings toward various projects that emerged thanks to that policy.

For example, projects that, before the reduction of interest rates, were not considered economically viable, are now considered viable.

Thus, before the artificial reduction of interest rates, the calculation of the net present value of various projects showed a negative result.

However, with the reduction of interest rates, the calculated net present value of those projects becomes positive.

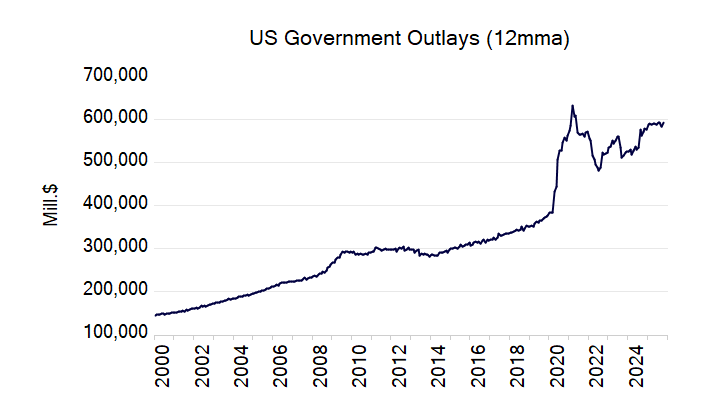

Government spending trajectory

Fed interest rates

In a freely functioning market, interest rates determined by monetary policy reflect individuals’ preferences between consumption in the present and consumption in the future, that is, saving.

In order to remain alive, individuals must have a higher preference for present consumption than for future consumption.

According to Mises:

“He who wants to live to see a later day must first of all take care of preserving his life in the interval. Survival and the satisfaction of vital needs therefore constitute prerequisites for the satisfaction of any desires in the more distant future.”

When individuals decide to increase future consumption relative to present consumption, this means that they have restructured the temporal structure of their preferences.

This will manifest itself through a reduction in market interest rates.

The reduction in interest rates is accompanied by an increase in saving.

The increase in saving provides the means of subsistence for individuals who will be employed in the various stages of production of future consumer goods.

By contrast, the artificial reduction of interest rates by the central bank through inflation of money and credit ignores the temporal allocation of individual preferences and private savings. The result is well known: societies live beyond their real means, mortgaging the future.

Instead, interest rates are reduced due to the desire of policymakers to “stimulate” current and future economic conditions.

However, this reduction in interest rates is not accompanied by an increase in individual savings.

Social time preferences and the rate of private saving have not changed.

This means that easy money and credit are diverted into various projects that emerged thanks to expansionary monetary policy.

Projects that emerged as a result of the expansionary policy of the central bank may be spectacular in nature, such as those of artificial intelligence (AI). However, they may not be viable under conditions of unhindered market operation.

What determines the feasibility of these projects, the significant allocation of resources, is social time preference, private savings and consumer demand for such goods.

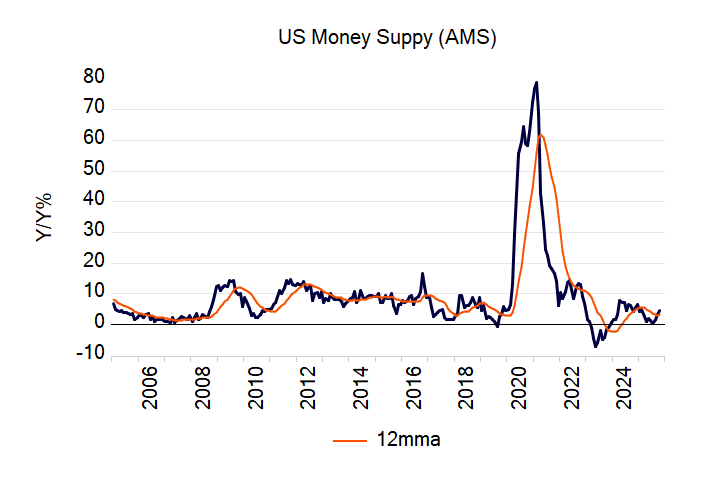

Money supply

Why bad investments are undertaken

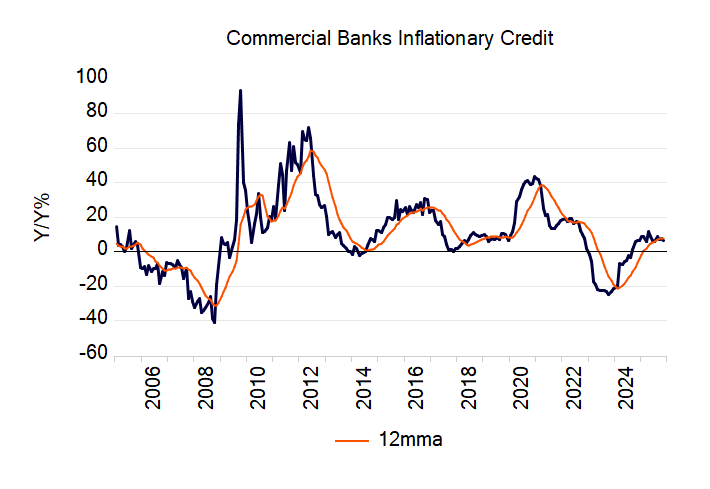

Expansionary monetary policies through a central bank that artificially expands money and credit distort the structure of production, partially supporting bad investments (malinvestment) in activities that would not have emerged, at least not at that time and not on that scale, in a free market.

It is reasonable to say that there is a diversion of resources from wealth producing activities to activities that do not produce wealth, except for those who benefit from them, such as the financial elite, as a result of the expansionary monetary policy of the central bank.

The extent of private saving limits the ability to realize various spectacular projects, such as those of AI.

Ignoring this reality through inflation and credit expansion means uneven inflationary price increases, currency debasement, distortion of the price and production structure, bad investments, boom bust cycles and economic impoverishment.

Consequently, regardless of how impressive various projects may be, what determines whether they are realistically viable is private savings, market interest rates and effective demand.

As things stand today, private saving and capital investment are under strain.

The main reason is continuously rising government spending and reckless monetary policy by the central bank.

In addition, the imposition of tariffs shrinks the structure of production and limits choices.

As a result, economic growth is likely to come under pressure, if it has not already happened.

The sharp reduction in the momentum of money supply growth since February 2021 is beginning to hit various activities that emerged thanks to the massive increases in money supply momentum between August 2019 and February 2021.

It is possible that the result of this massive inflationary increase in asset values such as stocks continues to dominate the economic landscape.

Over time, however, the impact of the large reduction in money supply momentum on economic activity is expected to manifest itself.

As a result, various “bubbles” are likely to collapse. The reason is that the easy money and credit that supported them will eventually weaken due to the reduction in money supply momentum.

Consequently, various bubble activities will not survive or, at the very least, will be forced to shrink.

The truth is that the temporal structure of preferences in society, private saving and capital investment may not be sufficient to support the expansion of various AI companies in a free market, for example.

Commercial bank lending

Consequently, assessing these activities in terms of their likely evolution in the coming months is futile.

The issue here is not how good these activities are, but whether they constitute bad investments and misallocated, unaffordable activities that emerged, in whole or in part, due to expansionary monetary policy.

Now, if the central bank were to aggressively cut interest rates and further increase the money supply, this would make matters much worse.

Inflationary bank lending is likely to collapse in the coming months.

As a result, the growth rate of the money supply is likely to follow the same path.

This is expected to exert even greater pressure on bubble activities.

A possible expansionary monetary policy by the central bank, combined with an aggressively expansionary fiscal policy, will deepen the economic crisis by weakening the process of wealth production.

Reduction of monetary intervention and fiscal rationalization

What is required to mitigate the crisis is the reduction, or elimination, of central bank intervention in financial markets and the drastic curtailment of government spending.

This will halt market distortions and allow a painful return to reality, or closer to it, in prices and production.

The proposition that replacing income tax with tariffs will mitigate a potential economic crisis is unlikely to work, given the upward trend in government spending.

Real tax revenue depends on the level of government spending.

Therefore, the higher the spending, the higher the real tax burden.

Rising government spending requires further diversion of savings toward public sector activities.

This, however, weakens wealth producers and, consequently, weakens economic growth.

Bubble activities are linked to the expansionary monetary policy of the central bank.

This type of policy creates various ventures which, in the absence of expansionary central bank policy, would never have appeared.

Various projects that emerged thanks to expansionary central bank policy may be impressive; however, given the shrinking volume of private savings available for capital investment, these projects are not feasible.

Regardless of how impressive these projects may be, they constitute bubble activities and are therefore likely to burst.

Moreover, the misallocation of resources arises not only because producers, due to central bank policies, ignore consumer market preferences, but also because of the reduction in real private savings.

The shock of landing back in the economic reality of fundamental conditions will be painful for the entire planet.

www.bankingnews.gr

Readers’ Comments