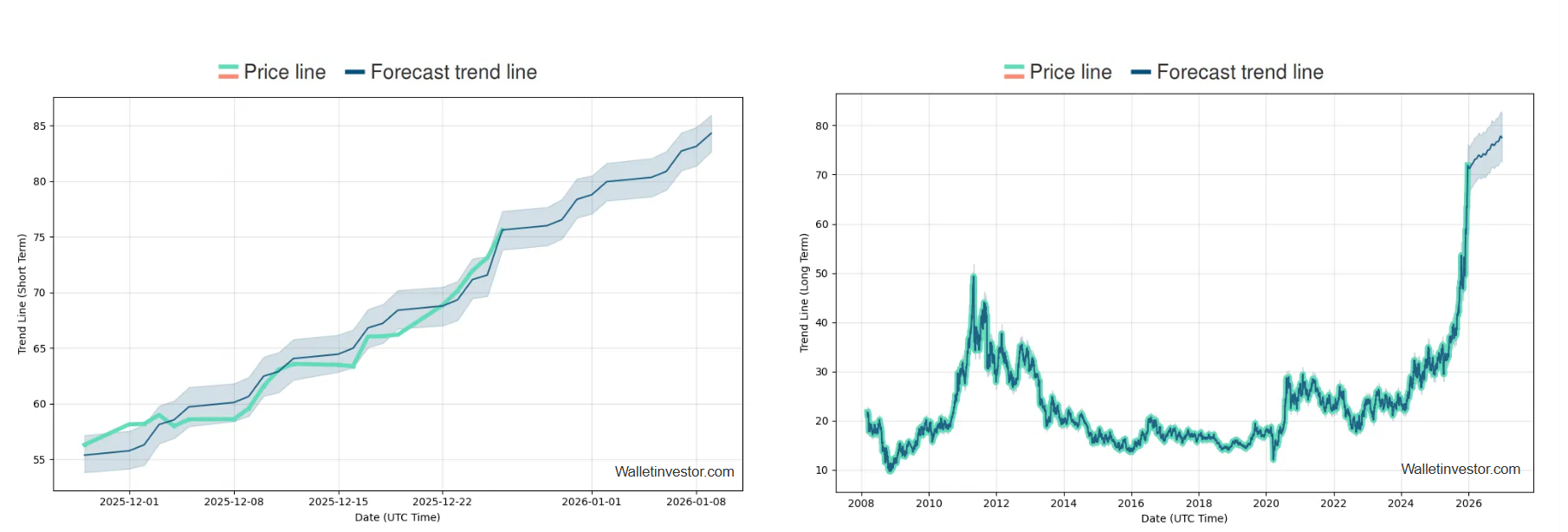

Silver is on track for its best year since 1979, as recent moves by China and global demand trends propel prices to historic levels, confirming the underground economic war over raw materials among major economies.

On Friday (26/12), the precious metal recorded a rise of 6.29%, reaching 76.37 dollars per ounce, with a total increase of 159% since the beginning of the year, more than double the rise of gold.

Precious metals are considered a safe haven for investors against turbulence and this year their demand has surged due to fears over inflation, geopolitical tensions and the sovereign debt of developed economies.

More recently, the impending regulation of exports by China has intensified anxiety over the adequacy of the precious metal: from January 1, exporters of silver, tungsten and antimony will be required to obtain a license from the Ministry of Commerce (Mofcom), restricting access to the metal.

China is the second largest supplier of silver after Mexico, producing 3.300 tons in 2024, three times the amount produced by the United States.

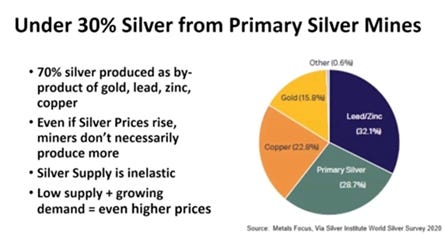

The lack of physical supply is compounded by the fact that 70–80% of the silver mined is a byproduct of other metals such as lead, zinc, copper and gold, which constitutes a fatal flaw for the commodity.

The surge in price

The structural constraint of the market

This means that the price of silver cannot by itself trigger an increase in production.

If the mining of base metals does not increase, the supply of silver remains constrained.

The market is thus structurally and permanently constrained, while demand is surging from investors, industries and the development of technologies such as solar panels, electric vehicles and AI data centers.

Silver is the “blood” of modern technology.

It is found in the iPhone, electric vehicles, solar panels and artificial intelligence servers.

Without sufficient physical stock, the global industrial economy risks grinding to a halt: production lines will stop, product launches will be delayed, the green energy transition will slow down and the AI revolution will hit a wall.

A recent analysis identified the world’s largest “impending silver mines”, not traditional mines, but technological and energy giants such as Samsung, Apple, Tesla, Microsoft, NVIDIA and First Solar.

These companies consume enormous quantities of physical silver, and its shortage could seriously disrupt their supply chains.

The future points to a crisis that could explode prices.

When limited silver inventories are depleted, the price of physical metal will have to rise to levels that either reduce demand or encourage new production, a development that could lead to dramatic market upheavals.

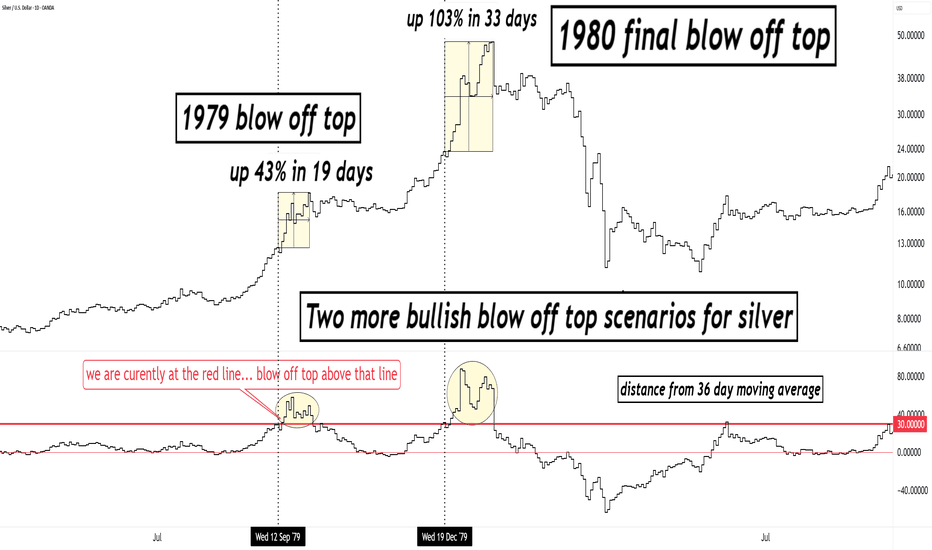

The attempt to manipulate the market in the 1970s

Historical experience from the attempt by the Hunt brothers in the 1970s, which pushed the price of silver to 50 dollars per ounce before the market collapsed, shows how sensitive the market is to supply and demand imbalances.

Nelson Bunker Hunt and William Herbert Hunt, exploiting inflation and monetary instability of the era, began buying massive quantities of silver and futures contracts, essentially seeking to control global supply.

Their strategy led to a rapid rise in the price of silver, which reached nearly 50 dollars per ounce in 1980.

However, when exchanges changed trading rules and sharply increased margin requirements, the Hunts were unable to meet their obligations.

The market collapsed abruptly, an event that became known as Silver Thursday, causing enormous losses both for the Hunts themselves and for the broader market.

This episode highlighted the risks of excessive leverage and made it clear that no group, no matter how powerful, can control an international commodities market in the long term.

The imbalance of supply and demand

Today, CEOs and supply chain managers are called upon to confront the greatest strategic problem for global industry: how to secure adequate silver supply in a market that cannot respond to rising demand.

Investors, on the other hand, face a generational opportunity: the supply demand imbalance in silver can translate into huge profits, but at the same time it constitutes a serious threat to the stability of the global economy and the value of all “paper” assets.

Market forecasts and historical data follow below

The fatal flaw of the precious metal

To understand the depth of the impending crisis, one must first understand a fundamental truth about silver production: silver does not control its own fate.

A striking proportion, approximately 70–80% of the silver mined globally, does not come from dedicated silver mines.

Instead, it is a byproduct of processing other metals, primarily lead, zinc, copper and gold.

This is the fatal disadvantage of silver. It means that no matter how much its price increases, the mining industry cannot simply decide to produce more.

Silver supply is hostage to the economic viability of other metals.

If the mining of lead, zinc and copper does not increase, there can be no meaningful increase in silver production.

This is the unpleasant truth that silver advocates have been warning about for years and which major financial media have systematically ignored.

Silver supply is inelastic.

It cannot respond to price signals like other commodities.

It is a market that is fundamentally, structurally and permanently problematic, yet it determines the future of the global economy.

www.bankingnews.gr

Readers’ Comments