Something major is happening with the most ancient asset, which has a life of 5.000 years.

The price of gold approached for the first time 4.5 thousand dollars per troy ounce.

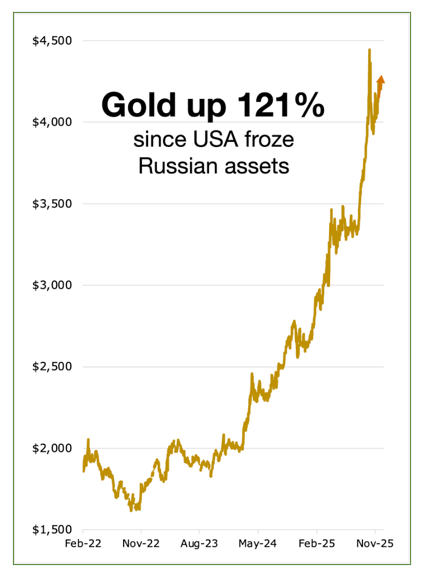

Since the beginning of 2025, the cost of the precious metal has already increased by almost 70% and has broken the historical record more than 50 times.

According to experts, investors around the world have begun to buy the asset more frequently in order to preserve the value of their capital amid growing global uncertainty and weakening of the dollar.

In addition, in recent times, the central banks of various states have been actively strengthening their gold reserves, a fact which has also had an upward effect on prices.

Analysts estimate that, in the context of discussions about the seizure of Russian reserves by the West, many states began to think about the security of their capital and to choose gold.

At the same time, the sharp rise in gold prices has already allowed the Russian Federation to offset almost two thirds of the “frozen” assets.

One record after another

On Monday 22 December, global gold prices repeated their historical record.

During trading on the New York Mercantile Exchange (Comex), the price of the precious metal increased by 1.4% and for the first time in the history of observations approached 4.453 dollars per ounce.

Since the beginning of 2025, gold prices have broken the record for the 52nd time.

This is largely due to the sharp increase in global demand for the precious metal, reports Alexei Lossan, analyst at the financial platform Sravni.

“We are seeing a generalized increase in global economic and geopolitical uncertainty.

Under such conditions, investors traditionally begin to direct their capital into so called defensive assets, with gold as the main one, in order to preserve their money with greater security. In addition, in an environment of lower interest rates in the United States and Europe, the attractiveness of investment products that offer interest decreases, which makes the precious metal even more competitive,” explained the RT interlocutor.

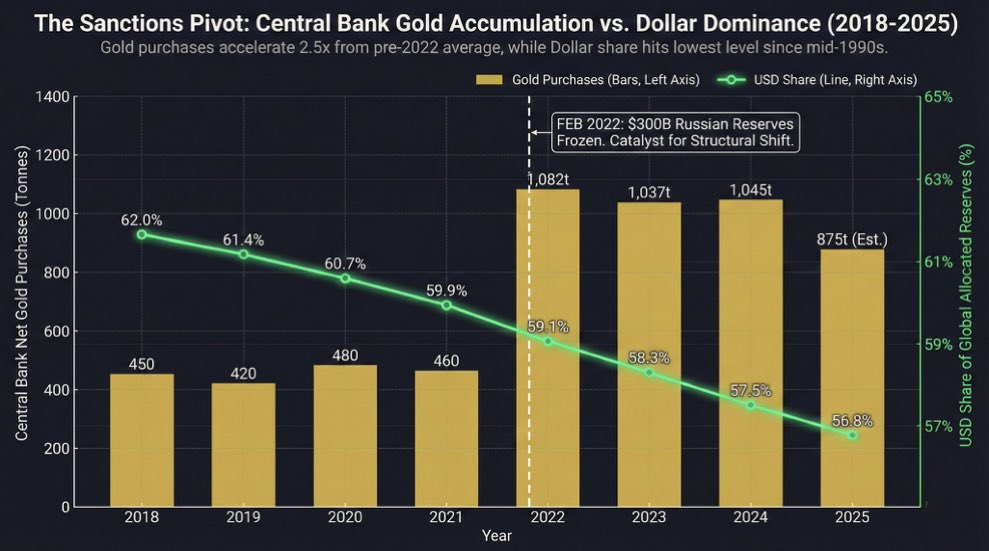

It is interesting that, alongside the rapid rise in the price of gold globally, a noticeable depreciation of the dollar is now being observed.

As the deputy Minister of Finance of Russia, Alexei Moiseev, had previously noted in an interview with RT, these are “directly interrelated phenomena”.

Thus, since January, the Dollar Index (DXY) against a basket of other reserve currencies has declined by more than 9% and is now moving around 98.5 points.

In addition, in September its value temporarily fell to 96.2 points, the lowest level since February 2022, comparatively, gold has increased in price by more than 68% since the beginning of the year.

The overturning of the global financial system

The dollar based global financial system no longer reflects today’s realities and, in this context, demand is steadily increasing worldwide.

As Alexei Moiseev explained, the dollar based global financial system, which was shaped by the Bretton Woods agreements after the Second World War, no longer reflects today’s conditions.

For this reason, demand for the precious metal is steadily increasing worldwide, estimates the deputy head of the Ministry of Finance.

“The Bretton Woods agreements were built around the dollar as a global reserve currency and the departure from this system obviously raises a question for all participants in the global economy: if not the dollar, then what?

I have no other answer than gold.

And I believe that many of those who today are driving up the price of gold by buying it share the same view,” stated Moiseev.

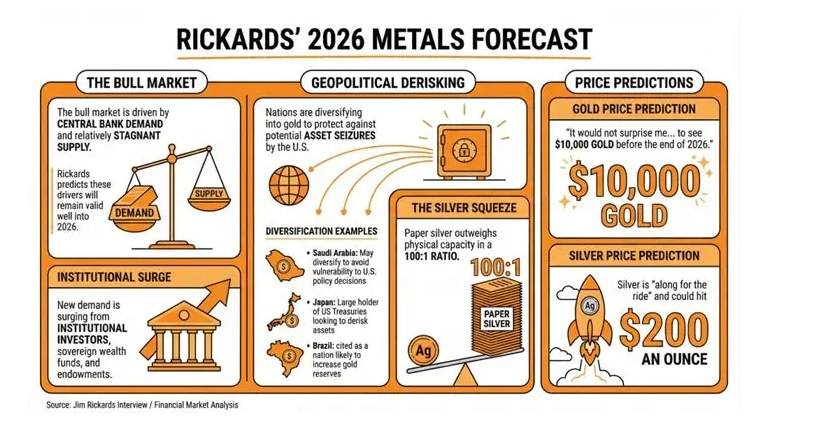

As argued by Dmitry Vishnevsky, analyst at Zyfra Broker, next year the pace of gold’s rise may slow and prices may stabilize near 4.5 thousand dollars per troy ounce.

At the same time, economist and senior executive in the field of financial communications Andrey Loboda believes that in 2026 prices will tend toward the level of 5.000 dollars.

“Tariff wars and the policy of economic protectionism of the United States fueled the rise in gold prices at the beginning of the year.

This factor will obviously remain active throughout the presidential term of Donald Trump,” Loboda said in an interview with RT.

Alexei Moiseev is also convinced that the current rise in gold prices “is not the ceiling”.

Moreover, as the deputy minister noted, some analysts do not rule out that in the long term the cost of the precious metal could even increase multiple times.

“There are different forecasts.

I met several Russian scientists who said that gold would cost 35.000 dollars per ounce. I do not know if it will happen or when. But it is absolutely obvious that as the role of reserve currencies declines, and especially of the dollar, we are not talking about sterling and the rest, people will turn more and more to gold,” he added.

Search for credibility

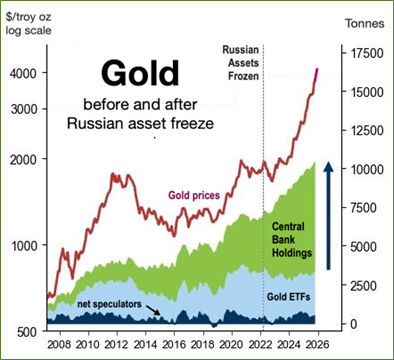

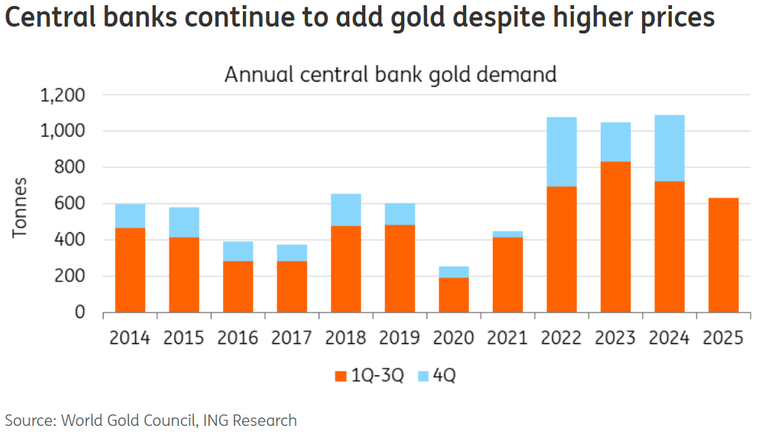

It should be noted that, alongside investors, gold is now also being actively purchased by the central banks of many countries.

In this way, global central banks are trying to diversify their assets, as Alexander Shneiderman, head of the client support and sales department at Alfa-Forex, told RT.

“Gold purchases by regulators are long term and systematic, under conditions of high uncertainty in the global economy and financial markets.

The precious metal is traditionally considered an asset without credit risk and without dependence on a specific issuer, which makes it a convenient tool for balancing reserves amid rising public debt in developed countries and the gradual weakening of trust in fiat currencies,” he explained.

Inflation and the pandemic

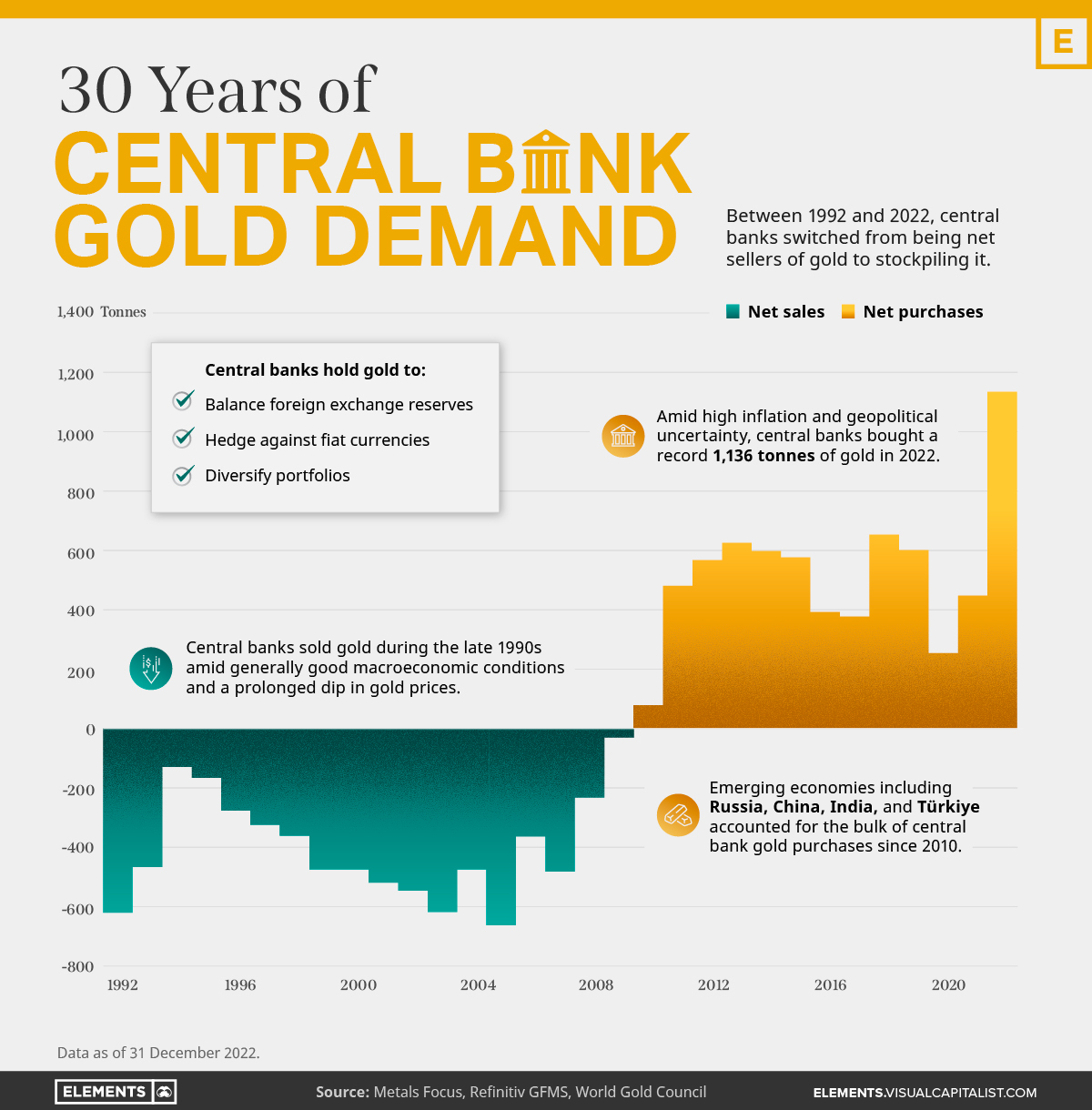

The trend toward active gold purchases by central banks began several years ago.

Initially, regulators began to invest in the precious metal in order to protect gold and foreign exchange reserves from inflation, as a consequence of the coronavirus pandemic.

However, the volume of purchases increased sharply in 2022, after the West blocked almost half of Russia’s gold and foreign exchange reserves.

“Demand for gold from global central banks has reached record levels and purchase volumes continue to grow.

The reason is the fiasco of the West and especially of the European Union, which blocked a significant part of Russian reserves and is now attempting to seize them.

Such actions undermine the trust of global investors in the financial system of the European Union: many investors and central banks began to doubt the reliability of capital storage in Europe and, as a result, are actively seeking alternative solutions,” explained Andrey Loboda.

The central bank fever for the precious metal

It should be noted that, if from 2010 to 2021 global central banks were buying in total from 104 to 660 tons of gold annually for their reserves, from 2022 onward the annual volume of purchases began to exceed 1.000 tons, according to data from the World Gold Council (WGC).

According to the latest data of the organization, in July 2025, among the five most active buyers of the precious metal were the central banks of Poland, Kazakhstan, Azerbaijan, Brazil and Turkey.

Significant demand for gold was also recorded from regulators in China, Czech Republic, Iran, Cambodia, Ghana, Guatemala, Indonesia, Qatar, Kyrgyzstan, Serbia, India and Bulgaria.

“The blocking and the discussed seizure of Russian reserves by the West acted as a key catalyst for the increase in gold purchases by global central banks, accelerating de dollarization even among allies of the United States.

Central banks choose gold as a politically neutral and seizure resistant asset, which reflects a structural shift of emerging economies toward diversification away from the dollar,” explained Dmitry Vishnevsky.

Restoration of reserves

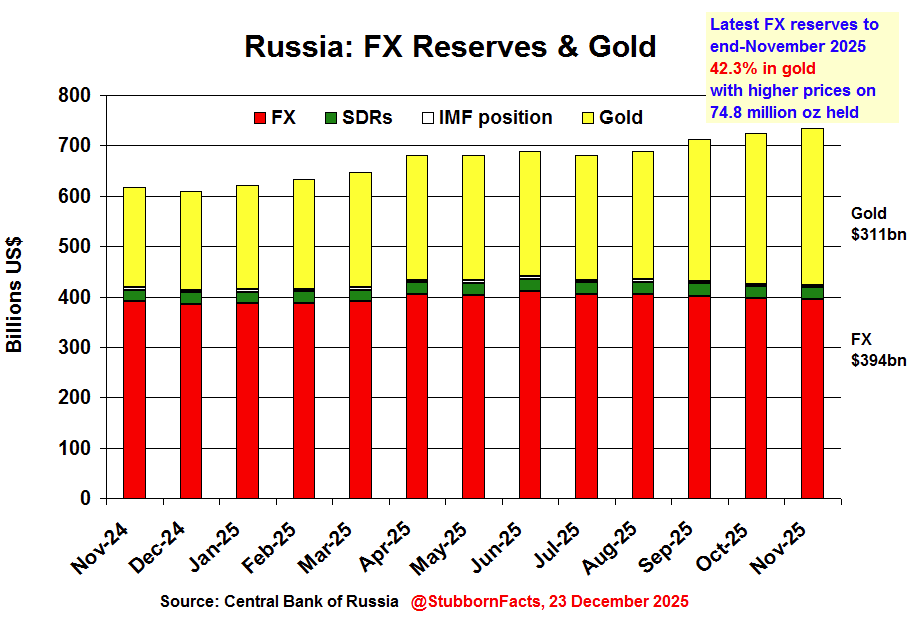

It is worth noting that Russia began to diversify its gold and foreign exchange reserves already before 2022.

Thus, a few years before the start of the special operation in Ukraine, the Central Bank of the Russian Federation withdrew significant funds from Western, mainly American, assets and began transferring capital into gold and yuan. Nevertheless, until the end of 2021, part of Moscow’s reserves, approximately 280 billion dollars, continued to be held in currencies and securities of European Union, G7 and certain other states and was “frozen”.

In response, Russia prohibited foreigners from selling Russian securities, as well as the withdrawal of capital from the country’s financial system. As a result, the funds of investors and companies from unfriendly states were blocked on its territory in a corresponding amount.

At the same time, the rapid rise in gold prices in recent years has mitigated the loss of that part of the reserves that was frozen by the West.

Thus, since the beginning of 2022, the physical volume of the precious metal in the vaults of the Central Bank increased only slightly, from 74 million to 74.8 million ounces, however its value more than doubled, from 133 billion dollars to nearly 311 billion dollars.

“For Russia, the rise in gold prices is generally beneficial. The country is among the largest producers of the precious metal and the high price directly pushes upward export revenues and the incomes of companies in the sector.

In addition, the increase in the price of gold strengthens the value of gold and foreign exchange reserves and reinforces the role of gold as an element of financial stability under conditions of limited access to part of external capital markets,” concluded Alexey Lossan.

The monetization of gold will bring significant upheavals to the global financial system.

www.bankingnews.gr

Readers’ Comments